Studies Show Group Captives Typically Aid Members' Risk Control Efforts

Captive Resources | October 11, 2023

Editor's Note: This article is contributed by Captive Resources, LLC. It examines the workplace safety and risk control benefits companies can realize as part of joining group captives.

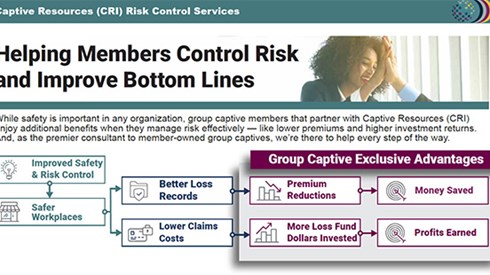

The decision to join a group captive insurance company is not one to take lightly. But there is good news for companies weighing that decision as part of efforts to improve their risk control. Macro- and micro-level studies of group captives* indicate that member-companies improve workplace safety and risk control after joining. Let's look at a few of the studies.

Leveraging Group Captive Support To Control Risk

Before we look at the studies, here are some of the many ways in which group captives help enhance member-companies' risk control efforts:

- A risk control assessment (RCA) that identifies areas of strength and weakness in member-companies' risk control methods

- Access to risk control workshops and webinars that offer educational opportunities on a wide variety of risk management topics and share best practices for enhancing safety and risk control programs and worker health and productivity

- Networking opportunities to share successful strategies with risk control leaders at other member-companies

One trucking company can attest to the effectiveness of group captive support in the form of these resources, among others. When the company joined a group captive in 2014, it already had solid risk control and safety programs in place, along with a desire to get even better. In 2018, with the support of the group captive, the company began ramping up those efforts significantly in the following ways:

- Renewing its commitment to controlling risk and improving workplace safety. It hired new risk and safety professionals and was then able to more fully leverage the risk control resources available through the captive.

- Revising its fleet risk control assessment (FRCA)—a transportation-focused version of the RCA, adopting a more stringent version to ensure a continuous focus on the safety considerations most pertinent to the company and a more accurate representation of its risk control activities and policies.

- Transitioning to a new independent transportation expert as its risk consultant. The consultant came in with a mandate from the member to be extremely rigorous when evaluating the company's safety practices.

By 2022, the company achieved the following success:

- A significant FRCA score increase despite adopting a more stringent assessment in 2018

- A dramatic advancement in Unsafe Driving (U-Driving) scores—a metric the Federal Motor Carrier Safety Administration uses to grade motor carriers

- A substantial improvement in the company’s Vehicle Maintenance (V-Maint) score—a measurement of vehicle maintenance violations per miles driven

- An 80 percent loss ratio drop

Similar efforts have been shown to have a significant impact on the macro level in group captives as well. For example, an independent study of group captive members found that companies with 5- to 10-point higher risk control assessment scores had 15 percent fewer losses from workers compensation claims.

Examining the Financial Benefits of Improved Risk Control

Lower Premium Costs

Looking at the experience of a longer-tenured group captive member that also strengthened its risk control initiatives reveals one of the financial benefits of joining a group captive—the potential to lower premiums.

An industrial supply distribution company seeking more control of its insurance costs joined a group captive in 2006. Support from the group captive, such as the resources listed above, enabled the company to develop a culture of safety with measurable goals. Also, since group captives determine premiums based on each member-company's individual loss history, this member was able to significantly control costs over the long term.

- Over 15 years, the company's net premium fell by nearly half, whereas it would have nearly doubled if it had maintained traditional insurance coverage.

- The company's premium as a percentage of payroll declined by nearly two-thirds—despite a near-doubling of payroll over that time frame.

Dividend Potential

When member-companies control losses, they can—and typically do—receive a return of unused loss fund dollars in the form of dividends. According to a study of 15 mature group captives over 233 closed accident years, member-companies earned the following:

- Dividends in 98 percent of accident years

- Dividends of more than 15 percent in nearly 3 out of every 4 years

- $1.3 billion in dividends (23 percent) of the $5.6 billion they paid into their loss funds

The results of these studies confirm that group captive resources and support enable the typical member-company to raise its risk control efforts to the next level and reduce its cost of insurance.

*All studies referenced pertain to group captive insurance companies and member-companies advised by Captive Resources.

Captive Resources | October 11, 2023