From Good to Great: How Group Captives Help Members Manage Risk

January 05, 2022

Commercial insurance doesn't have to be just a reactive mechanism to pay for losses. Insurance programs can be a proactive device that empowers companies to control losses, minimize injuries and fatalities, and make their workplaces safer.

So, how can insurance inspire companies to manage risk more effectively? It's simple: ownership.

Captive Resources utilizes a member-owned group captive model that's built on a continuous and compounding commitment to risk control and safety. In the group captives we assist, member companies have an intrinsic motivation to take a comprehensive and collaborative approach to risk control. As equal shareholders in the insurance companies that provide them coverage, effectively managing risk not only saves lives, reduces injuries, and creates a more productive workforce, it can also have a significant impact on members' bottom lines.

Going from Good to Great

Group captives seek safety-conscious organizations with proven track records of managing risk. Maintaining a focus on best-in-class organizations (i.e., "good risks") typically leads to higher-quality risk pools than you'll find in the traditional commercial insurance market.

Once they join, Captive Resources—together with other risk management and safety professionals—provides companies with the expert resources and support they need to take their risk management programs from good to great. In addition, the collaborative nature of group captives promotes the sharing of best practices and mutual support among the member companies.

An Approach That Pays Dividends

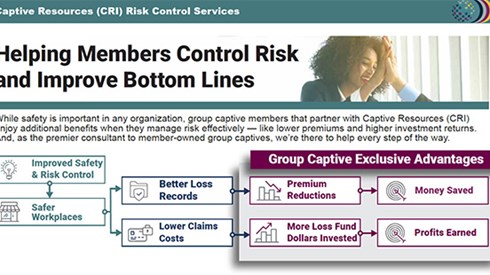

We've found this approach to risk control helps member companies:

- Improve loss records—because the group captives determine premium based on actual loss history, members have significant opportunity to drive down their insurance costs.

- Lower claims costs—as members lower their claim costs, more unused loss fund dollars are invested. Since members are shareholders of the captive, this underwriting profit becomes available to be returned to them as dividends.

To further illustrate the benefits of this more dynamic approach to risk control, we created an infographic that summarizes:

- The risk control resources that group captives provide members, including:

- Annual Risk Control Assessment (RCA)

- Biannual Risk Control Workshops

- National Safety Council membership

- How these resources have helped members to make their workplaces safer and what that improved safety means for member companies, including independently verified:

- Impact of workshop attendance

- Dividend performance

January 05, 2022