Group Captives Offer Transportation Firms a Solution for Swelling Verdicts

August 04, 2023

Editor's Note: This article is contributed by Captive Resources, LLC. It examines the cost control advantages transportation industry companies and other businesses can gain through the use of group captives.

An executive brief from the Insurance Information Institute (Triple-I), Group Captives: An Opportunity To Lower Cost of Risk, includes both good and bad news for the transportation industry. First, the bad news: the industry faces a growing financial threat from increasing legal costs. According to the American Transportation Research Institute (ATRI), average legal verdicts against US trucking companies increased by a colossal 967 percent from 2010 to 2018.

The good news: group captive insurance can be a viable solution to the rapidly growing commercial insurance premiums brought on by (among other factors) increased legal costs for companies in industries including transportation. We'll discuss group captives in more detail, but first, let's look at the transportation industry's increasing insurance and legal costs and some underlying causes.

The Transportation Industry's Increasing Legal Costs

Other recent studies confirm related legal and financial trends in the industry of concern to insurance decision-makers.

- Verdict award growth exceeds inflation. ATRI also reports that from 2010 to 2018, average verdict awards against trucking companies increased by 51.7 percent per year, compared to inflation growth of 1.7 percent during the same period.

- Accidents involving trucks are increasing. According to the National Safety Council, more than 5,700 large trucks were involved in fatal crashes in 2021—a 49 percent increase from 10 years earlier. Also, the number of trucks involved in crashes resulting in an injury has increased by 15 percent since 2016.

- Commercial trucking insurance rates are rising. Insurance broker Marsh & McLennan reports that average annual commercial insurance rates for commercial trucking jumped an unprecedented 20 percent to 25 percent from 2019 to 2021.

Multiple factors appear to be influencing juries and causing the growing verdict awards.

- The Baker Sterchi Cowden & Rice law firm blames the readmittance of litigation advertising and significant personal injury settlements and awards following highly publicized lawsuits starting with the "McDonald's Scalding Coffee" case in the 1990s.

- FreightWaves, a price reporting agency and data provider to the global supply chain, reports that several hedge funds are financing lawsuits in the trucking industry and receiving a significant share of the awards when juries decide in favor of plaintiffs.

- In a recent Transport Topics article, public relations firm Marathon Strategies attributes larger verdicts to corporate mistrust, increased negative media directed toward corporations, and a lack of tort reform in many states.

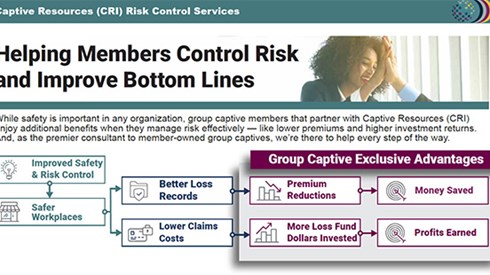

Group Captives Offer Inherent Cost Control Advantages

Many transportation companies need help controlling their total cost of risk as their commercial insurance policy premiums increase substantially year over year, even if they have solid safety records. Additionally, they now face greater potential legal exposures and legal costs. In this new business environment, group captive insurance offers transportation companies inherent advantages that can enable them to take more control of these insurance and legal costs.

The Triple-I executive brief contains a review of how group captive insurance companies operate and the benefits. Below are some benefits of group captives that can help transportation companies lower their overall cost of risk and potentially offset higher legal costs.

- Premiums are based primarily on member companies' actual loss experience, affording them the opportunity to lower their premiums by controlling their losses.

- Member companies gain greater transparency and participation in the claims adjudication process, which can help to close claims more quickly and with potentially more favorable outcomes.

- Group captives attract companies with best-in-class safety records that collectively form a preferred-risk pool.

- Group captives offer programs such as risk control workshops and monthly webinars that provide best practices in areas such as worker safety. The continued commitment to improving risk control and safety helps members reduce the frequency and severity of losses.

- Member companies have the potential to earn dividends from unused loss funds, a financial benefit that can help offset growing legal costs.

You can learn more about the benefits of group captive insurance by reading the full Triple-I executive brief, Group Captives: An Opportunity to Lower Cost of Risk.

August 04, 2023