Insurance Information Institute Paper Cites Benefits of Group Captives

March 24, 2023

Group captive insurance companies can provide certain companies a source of value in inflationary times, the Insurance Information Institute (Triple-I) says in a new executive brief.

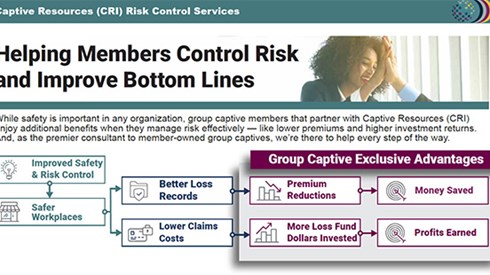

In the report, Group Captives: An Opportunity To Lower Cost of Risk, the Triple-I notes that group captives can help reduce costs and improve cash flow for certain risks with the added benefit of returning unused loss funds and income to group members through dividends.

The Triple-I noted that group captives recruit safety-conscious companies with better-than-average loss experience. Because each member's premium is based on its own recent loss history, membership in a group captive can often result in lower premiums.

"This contrasts with commercial carriers, who base their premium on a number of factors including industry-wide loss experience," the Triple-I said. "According to a recent study, almost three-quarters of new bound policies in group captives have lower costs than the members' previous plans. In fact, roughly 30 percent of new policies saw a savings of 20 percent or more."

Group captive members can see even greater premium savings by the second or third year of membership through an increased focus on pre-loss risk management and post-loss claims management, the Triple-I said.

The Triple-I paper also suggested that group captives tend to benefit their members through increased financial flexibility and protection against losses due to greater control of and transparency into insurance program costs.

"Group captives can provide a viable way to protect companies across several lines of casualty insurance," the Triple-I report said. "Their prominence is likely to grow as economic and litigation trends continue to increase costs."

March 24, 2023