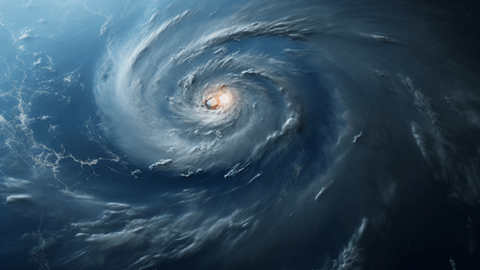

Catastrophe Risks

FEMA Expands Reinsurance Program, Transfers $575M in Flood Risk

The Federal Emergency Management Agency (FEMA) has announced the expansion of its reinsurance program, transferring $575 million in flood risk to capital markets. Read More

Aon Report Highlights Surge in Billion-Dollar Disasters for 2023

Aon's "2024 Climate and Catastrophe Insight" report findings show global economic losses from natural catastrophes in 2023 reached $380 billion. Read More

FloodFlash Continues US Expansion of Parametric Flood Insurance

FloodFlash has expanded availability of its sensor-enabled parametric flood insurance coverage to 10 additional US states. Read More

A New Tokenized Reinsurance Blockchain Arrangement Launches

An industry loss warranty contract was launched to leverage blockchain technology through tokenized reinsurance for catastrophic weather events in Florida. Read More

Thunderstorm Losses Break Records in 2023, Per Munich Re

In a recent update, Munich Re reported worldwide natural disasters in 2023 resulted in losses of around $250 billion, with insured losses of $95 billion. Read More