As Businesses Evolve, So Can Their Approach to Captive Insurance

April 14, 2021

For some companies, the move into captive insurance can be a process that evolves with the business, with the organization starting with a segregated cell before ultimately moving into a wholly owned captive.

"What happens when you start to outgrow the structure that you've put in place?" asked Jeff Packard, assistant vice president, Specialty Markets, at PMA Companies.

Mr. Packard made his comments as part of a Captive Insurance Companies Association 2021 Digital Education Series webinar titled "Navigating from a Segregated Cell to a Wholly-Owned Captive." The session examined the experience of Warehouse Services Inc. (WSI) on its journey from traditional insurance to a group captive to a segregated cell and, ultimately, to owning its own single-parent captive insurance company.

"When talking about traditional insurance versus captives, in a traditional approach you in essence pay a premium and transfer the majority of risk to the insurance company," Mr. Packard said. "In addition, you have very little control. By utilizing a captive approach, you can structure various ways of taking risk and by doing so receive the benefit associated with owning your own insurance company."

It's important to note the economies of scale that might become available as companies move along the size and premium spectrum, said Justin Felker, area vice president at Arthur J. Gallagher & Co.

For businesses at lower fixed-cost premium levels, a group captive or a segregated cell could make sense. "You start to get to $5 million or upwards, and then you can open up the door to some more options with a single-parent captive," Mr. Felker said. "That's sort of the spectrum we walked along with WSI."

Barry Cox, president of Warehouse Services, noted that prior to 2003, the company was in the traditional insurance market. The company entered a group captive in 2003 before moving into a segregated cell in 2007. In 2020, the company created a wholly owned captive.

"We began our journey in the insurance market, back in 1988," he said. "We did use a fully insured product at the time."

Working with Arthur J. Gallagher, "we decided that moving into a group captive would be a good solution to support our insurance requirements," he said. The company's objectives were to control insurance costs and develop a more sophisticated approach to loss prevention.

"We were less than a spectacular firm from a loss prevention standpoint at that time," Mr. Cox said. But the company began investing in its safety program when it moved into the group captive and saw improvements in its loss experience. "The safety team became excited about trying to drive a more sophisticated approach to safety," Mr. Cox said.

"The group captive was a great experience for us in that it introduced us to the concept of captives and how they work," Mr. Cox said. It also allowed Warehouse Services to see how other companies viewed risk and insurance, and it generated dividends that could be put back into the company's safety efforts.

As Warehouse Services grew, opportunities emerged for the company to retain more risk and underwriting profits, while its safety culture had become more mature, Mr. Felker said. The next step was a segregated cell.

"In this case, we had gotten to a point where Warehouse Services could contemplate a protected cell approach," he said. Using a cell provided the company a chance to rent versus own, which kept expenses down. "It really provided an opportunity to rent before owning and walk before we run," said Mr. Felker.

"Our loss history with the segregated cell was good, and, as we were able to analyze those losses, we were able to take more risk with a larger deductible," Mr. Cox said. Warehouse Services was able to develop some reserves, but there were issues with the cell approach, including low investment returns. The company began looking for other ways to achieve its necessary insurance solutions.

After about 13 years in the segregated cell, Warehouse Services decided to move into a single-parent captive. Working with various partners including consultants, accountants, and legal counsel, "we started exploring the concept of a wholly owned captive," Mr. Cox said. "Our business was already comprised of over 20 companies that had some risk shifting and sharing possibilities within it, and starting an insurance company sounded like maybe a good complement that would balance the business out as we continued to grow."

The company was spending a large amount on insurance premiums, and its growth on the transportation side of the business along with nuclear verdicts that were becoming common in the market made it clear that Warehouse Services needed to build surpluses to prepare for the sorts of unexpected events that affect every business sooner or later.

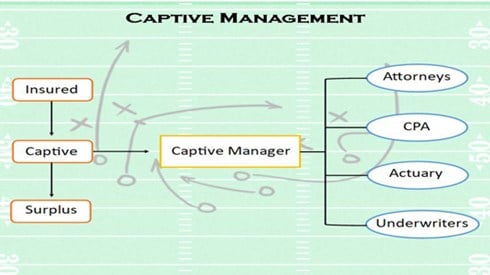

Mr. Packard noted that there are many behind-the-scenes factors in making the transition from a segregated cell to a wholly owned captive a reality. Among other things, the captive manager's role is critical, he said.

"The captive manager's role in that transition is to always constantly make sure that that movement is happening," Mr. Packard said, including ensuring that reinsurance contracts are in place and taking charge of any filing and licensing requirements with domicile regulators.

There's also the captive feasibility study and possible issues with banks, investment groups, and fronting companies, he said. And at some point, funds will have to be moved from the cell to the new single-parent captive.

"There is a time period where money is being moved from the seg cell to the wholly owned captive," Mr. Packard said. "It's the little nuances that you have to be aware of when you start moving these things.

"It's probably a 6-to-7-month transition to get everything in place and ready to move," said Mr. Packard.

"I'd add to that that there's probably 12 months of work prior to that 6 or 7 months," said Mr. Cox.

While the move to a single-parent captive wasn't easy, "We've got our feet on the ground now. We're seeing much better investment returns from the surplus that's in the captive," Mr. Cox said. "We're able to start exploring other lines of business such as large deductibles on our healthcare insurance that we can add to this portfolio, and we've already started adding other companies to this business."

April 14, 2021