Swiss Re's Latest Sigma Study Focuses on Construction Sector

June 18, 2018

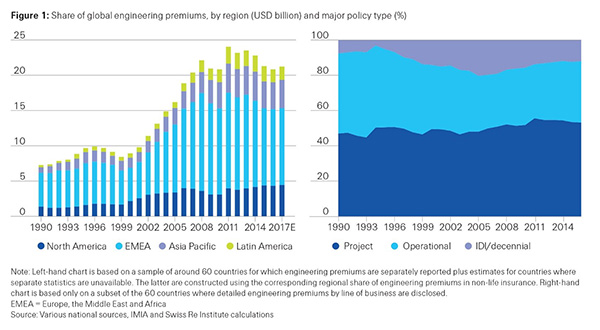

Global engineering insurance premiums for 2017 were estimated at around $21 billion but have stagnated in recent years according to the latest sigma study from the Swiss Re Institute. Underwriting performance has deteriorated recently, with premium rates declining and claims rising in some construction sectors. Urbanization, the replacement of aging infrastructure, and the development of renewable energy sources should all promote construction spending and engineering insurance demand.

New technologies could also lead to significant improvements in efficiency including enhanced monitoring, mitigation, and management of engineering-related risks, although they create new risks.

Comprehensive data on engineering premiums are lacking in the market. Based on extensive research of available country-level sources, Swiss Re Institute estimates global engineering insurance premiums for 2017 were at around $21 billion. This represents roughly 3 percent of total commercial insurance premiums (around $730 billion in 2017). Around half of the market is accounted for by project insurance, which protects against risks incurred during construction or installation of plants, buildings, and infrastructure.

After rising rapidly through most of the 2000s as construction activity in a number of developing countries soared, global engineering premiums have stagnated in recent years. Construction spending as a percent of gross domestic product in many advanced markets remains below its pre-2008 financial crisis peak, while some key emerging markets are only slowly emerging from recent recessions. The European, Middle Eastern, and African region nonetheless continues to generate the largest share of global engineering premiums, mostly due to the popularity of operational covers such as machine breakdown and construction insurance (Figure 1).

Structure of the Engineering Insurance Market Is Evolving

Diversification for large, complex engineering risks is achieved via a combination of national (e.g., retail), insurance, and wholesale co-re/insurance subscription markets. While London remains an important center for engineering and construction-related insurance, especially for high-value projects that are technically demanding to underwrite, increasingly engineering risks are being underwritten from the international hubs of Singapore, Dubai, and Miami. Domestic brokers are especially active in arranging insurance for local construction projects, while international brokers play a key role for complex projects that require specialist expertise and/or those where foreign funding is involved.

Underwriting Performance Is Deteriorating

Underwriting performance has deteriorated recently, with loss ratios edging higher and claims rising in some construction sectors due to lower quality control. Reported loss ratios likely understate the recent deterioration in underwriting profits. Because ultimate loss experience takes time to become fully developed, claim settlements are often delayed. Soft underwriting market conditions have also depressed engineering insurance pricing. Mike Mitchell, head of Property and Specialty Underwriting at Swiss Re, says, "Engineering premium rates have been declining for over a decade. Some engineering insurers' profit margins may already have been squeezed close to or below levels that are sustainable over the long term."

The Growing Use of New Technologies in Construction

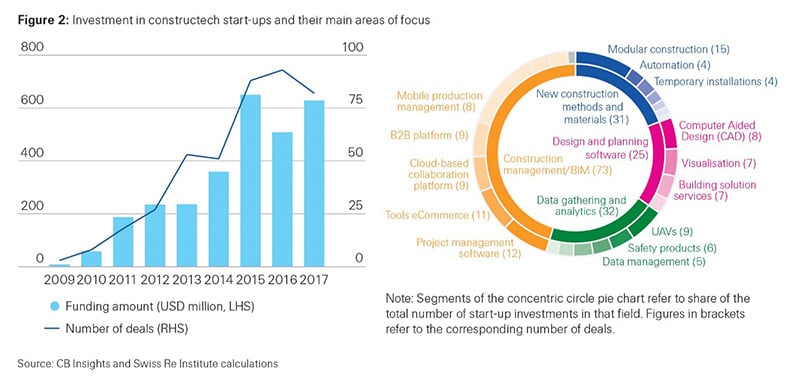

The construction sector is beginning to adopt digital technology and processes. Start-up companies are an important part of the emerging innovation narrative. More than 400 constructech firms have formed since 2009, raising $2.9 billion in funding, many of which are focused on tools to improve construction management (Figure 2).

While the use of digital technology could lead to significant improvements in efficiency, including enhanced monitoring, mitigation, and management of engineering-related risks, Mr. Mitchell says, "Technology also affects the nature of existing risks and brings with it new risks such as cyber. Insurers could see the severity of claims increase even if the frequency of accidents continues to fall." Product and process innovation will help insurers respond to the evolving risk and competitive landscape. In a digitally connected world, insurance may come to play more of a risk avoidance/mitigation role. This may ultimately require a more radical reconfiguration of engineering insurers' business models.

Market Outlook for Engineering Insurance

Beyond technological innovation, the outlook for engineering insurance is heavily influenced by prospective growth in the world economy. The ongoing cyclical economic upswing in advanced and developing markets in the near term should stimulate construction activity and insurance demand. Also, structural adjustments such as urbanization, the replacement of aging infrastructure, and the development of renewable energy sources should promote spending on construction. However, there is still uncertainty about how far some of these factors will translate into a material pick-up in premium growth.

The English, German, French, and Spanish versions of the sigma No 2/2018, "Constructing the Future: Recent Developments in Engineering Insurance" are available electronically on Swiss Re Institute's website: institute.swissre.com.

June 18, 2018