Secondary Perils Account for 60 Percent of NatCAT Losses in 2018

April 11, 2019

In its latest sigma report, Swiss Re revealed that the natural catastrophe loss experience of the last 2 years is a wake-up call for the insurance industry, highlighting a trend of growing devastation wreaked by so-called secondary perils (independent small to midsized events or secondary effects of a primary peril).

Total Insured Losses

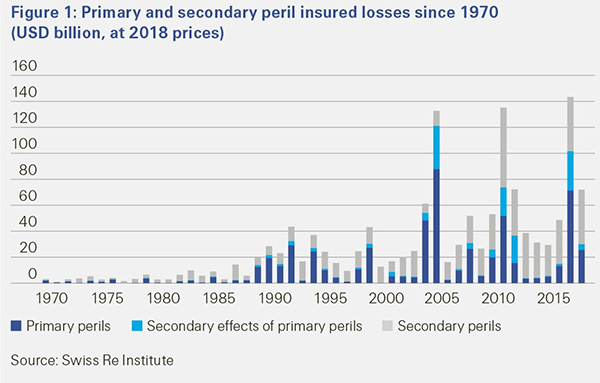

According to the report, insured losses from natural catastrophes in 2018 were $76 billion, the fourth-highest 1-year total, and more than 60 percent of the losses resulted from secondary perils. The insured losses from natural catastrophes in 2017 and 2018 together were $219 billion, the highest ever for a 2-year period. In 2017, when aggregate natural disaster insurance claims were the highest ever in a single year, more than half were due to secondary perils.

Losses from secondary perils are rising due to urbanization, rising concentration of assets in areas exposed to extreme weather conditions, and climate change. Swiss Re expects losses from secondary perils will rise due to growing assets in areas exposed to more extreme weather conditions.

Total Global Economic Losses

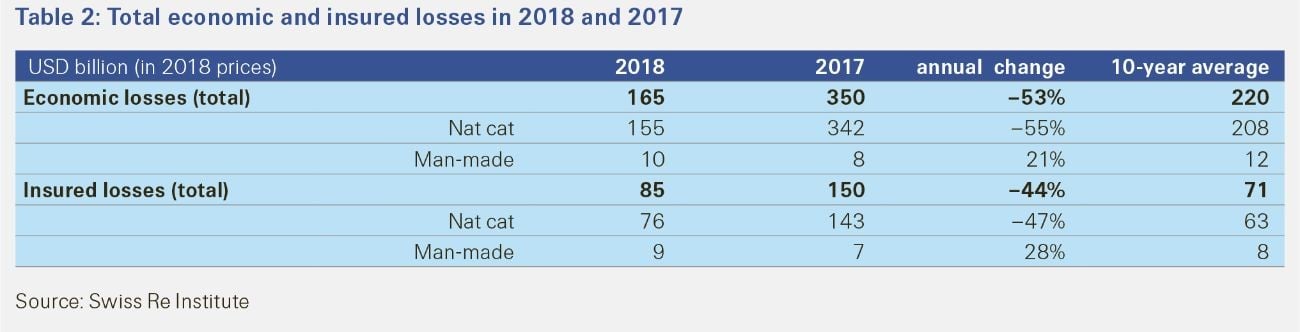

The report said that total global economic losses from natural catastrophes and man-made disasters in 2018 were $165 billion. The insurance industry covered $85 billion of global economic losses, the fourth-highest 1-year aggregate industry payout ever and above the previous 10-year annual average of $71 billion. Of last year's insured losses, $76 billion were due to natural catastrophes, also the fourth highest on record.

The risks posed by secondary perils tend to be underestimated because their impact is masked by the losses inflicted by primary events, as was the case in 2017 with Hurricanes Harvey, Irma, and Maria. However, their growing loss potential is becoming ever more apparent, according to Swiss Re.

"Large losses from secondary perils are occurring more regularly," said Edouard Schmid, Swiss Re's group chief underwriting officer. "This is a trend the insurance industry must act on so that we can continue to underwrite catastrophe business sustainably."

What Are Secondary Perils?

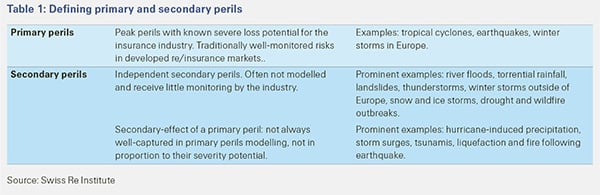

Swiss Re said industry practice has been to consider secondary perils as two types of event, as follows.

- Independent, high-frequency (i.e., more frequent than primary peril events such as earthquakes and hurricanes), low-to-medium-severity loss events (relative to losses resulting from primary perils)

- Events that occur as secondary effects of primary perils (e.g., a tsunami following an earthquake)

The table below provides more detail of secondary vis-à-vis primary perils.

The single largest insurance loss-event of 2018 was Camp Fire in California ($12 billion), according to Swiss Re. Other significant secondary peril events last year included a hail storm in Sydney in December and the secondary-effect flooding across the Carolinas in the United States in the aftermath of Hurricane Florence in September.

Losses from secondary perils have been rising due to rapid development in areas exposed to severe weather and warmer temperatures, and Swiss Re said it expects this trend to continue. While the probability outlook for more extreme primary catastrophes like hurricanes due to climate change remains uncertain, more extreme weather conditions and more frequent occurrence of resulting secondary perils is already reality in many places across the world, according to the reinsurer.

"Secondary-peril losses will accelerate due to ongoing urbanization, also in areas exposed to flooding such as along coastlines and in river plains, development in areas vulnerable to fire risk like wildland-urban interface, and also because of long-term climate change projections," Mr. Schmid said.

Swiss Re found that the combined $219 billion of insurance losses for 2017 and 2018 are indicative of a growing trend as seen below in Figure 1. While there were no mega-loss generating events in 2018, of last year's losses, 62 percent were due to secondary perils. The potential force of secondary perils is further supported by the peak loss experience of 2017, when Hurricanes Harvey, Irma, and Maria took the insured loss total for the year to the highest ever, according to the reinsurer. Even with these mega-loss events, more than half of the annual losses were due to (less well-monitored) secondary perils, said Swiss Re.

Closing the Protection Gap

The combined global natural catastrophe protection gap in 2017 and 2018 was $280 billion, with more than half resulting from secondary perils. Explanations for underinsurance include lack of consumer risk awareness, a poor understanding of the catastrophe cover available, and hesitation on the side of the industry to provide cover where risk assessment is uncertain, said Swiss Re.

Assessing secondary-peril risks can be difficult given their unique features. For example, secondary perils are often highly localized, but with variables that are in a continual state of flux given land-use changes and greater occurrence of extreme weather, according to the reinsurer.

Jérôme Jean Haegeli, Swiss Re's chief economist, said, "By leveraging latest technology, insurers can focus more on developing appropriately regionalized models to assess the risk posed by secondary perils and develop a greater product range and targeted distribution for catastrophe covers."

Swiss Re also encourages re/insurers to build socioeconomic resilience through their investment activities by investing more in sustainable infrastructure projects. According to Swiss Re estimates, global re/insurance assets amount to approximately $30 trillion. Even a small part of this could unlock a significant amount of capital for deployment into long-term resilience-building infrastructure projects, said the reinsurer.

April 11, 2019