CLIPS: US Commercial Insurance Rates Surpass 6 Percent Growth

March 14, 2024

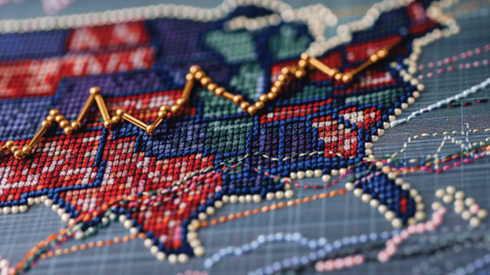

WTW's recently released Commercial Lines Insurance Pricing Survey (CLIPS) for the fourth quarter of 2023 reveals a consistent upward trajectory in US commercial insurance rates. According to the quarterly survey, which compares insurance premiums for policies underwritten during Q4 2023 with the corresponding period in 2022, insurers reported an aggregate commercial price increase of 6.6 percent. This marks a consecutive quarter upsurge of over 6 percent.

The most substantial price hike was observed in commercial auto, sustaining a double-digit increase, rising by nearly 4 percent from the previous quarter. Package CMP/BOP (commercial multiperil/businessowners policy) and general liability also demonstrated significant growth, surpassing rates from previous quarters.

Commercial property and excess umbrella coverages continued their trend of double-digit increases, as seen in previous quarters. In contrast, cyber and directors and officers liability (D&O) exhibited negative pricing trends consistent with prior quarters.

"Amidst the ongoing general upward trend, our latest data from the fourth quarter of 2023 reveals intriguing shifts in commercial insurance rates," said Yi Jing, director, insurance consulting and technology, WTW. "Notable increases were observed across various coverage areas, with some at or approaching double-digit growth, while others experienced minor declines. These findings underscore the dynamic nature of the market and highlight the importance of strategic adaptation while staying agile enough to pivot as the market may require."

CLIPS provides a retrospective analysis of historical changes in commercial property-casualty insurance prices and claims cost inflation.

March 14, 2024