Actuaries Adapt to Climate Change Using New Tools

Tyler Shalitis | September 13, 2017

On August 28, 2017, the National Weather Service tweeted an infographic of the rainfall from Hurricane Harvey, followed by a troublesome statement: "So much rain has fallen, we've had to update the color charts on our graphics in order to effectively map it." It is cause for concern that many indicators of climate change, such as extreme weather events, global temperature, and sea levels, continue to be on the rise. Fortunately for the insurance industry, actuaries are also rising to the challenges posed by climate change. One recent example is the creation of the Actuaries Climate Index ( ACI) and the forthcoming Actuaries Climate Risk Index (ACRI). These indexes were created jointly by the American Academy of Actuaries (AAA), Canadian Institute of Actuaries (CIA), Casualty Actuarial Society (CAS), and Society of Actuaries (SOA) to help actuaries address the challenges climate change has created.

These tools are necessary to respond to upward trends in weather-related losses. For instance, Munich Re has reported that since 1980, weather-related losses have increased nearly fourfold. The ability to quantify climate change is important, not just because of increasing losses but also because shifting climatic conditions could lead to unexpected types of losses like property damage in new regions. Such unforeseen losses may, in turn, necessitate new products or the redefinition of current products in order to adapt. There are also growing concerns over which entities could be held liable for future climate change costs. Regulators will face challenges as well: Will there be sufficient solvency, liquidity, and capital in the marketplace to finance these new risks? Because of these and other issues, regulators will need to consider whether to require a statement of catastrophic or extreme weather risk by the enterprise risk manager, actuary, or risk modeler.

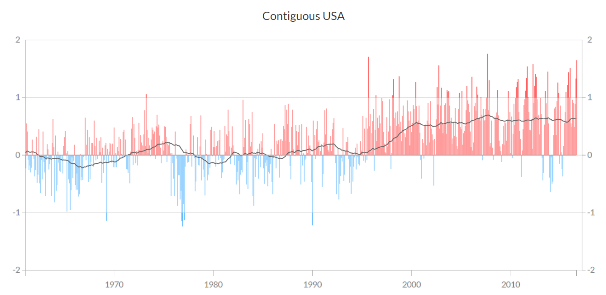

The ACI is one tool that has recently become available to actuaries. It uses a reference period of 1961 to 1990 for United States and Canadian climate data, which serves as a benchmark to evaluate how much the climate has shifted. Six carefully selected climate variables are averaged together to create the ACI: high-temperature events, low-temperature events, heavy rainfall, drought, high wind, and sea level. The ACI can also be broken down by component or region to provide more specific information based on user preferences. The graph below shows the total ACI for the contiguous United States using monthly data from the beginning of 1961 to the summer of 2016. An overall increasing trend can be seen since the reference period, with a higher index representing an increased occurrence of extreme weather.

ACI FOR THE CONTIGUOUS USA

Source: www.actuariesclimateindex.org, Copyright © Actuaries Climate Index. Reproduced with permission.

The ACRI is another index currently in development that is designed to relate loss data to climate data using regression analysis. The goal is to come up with a measure that quantifies historical climate risk. This historical ACRI can then be used to better predict the future risk and evaluate the impact of climate change. The ACRI is important for several reasons. First, actuaries simply need more relevant risk measures of climate and climate change. The ACRI is also significant because using traditional methods to measure climate risk, such as trending historical data, are often inadequate. This is because, as illustrated in the above ACI chart, climate can move in a cyclical fashion, move erratically from year to year, and show trends. Since the ACRI is derived using regression, the resulting models can better anticipate these climate shifts. The ACRI is further strengthened in that it is not only nationally aggregated but will be available by specific region, individual line of coverage, and even by specific hazard. For simplicity, the ACRI values are often mapped onto a value of 0 through 10, with 10 representing extreme climate risk, 5 indicating the same amount of climate risk on average when compared to the reference period, and 0 indicating virtually no risk.

The ACRI's multiple applications include pricing or portfolio diversification. The pricing applications are more obvious, as the ACRI is better equipped to anticipate long-term trends and patterns in climate change risk versus more traditional methods. Incorporating the ACRI into pricing models can potentially aid insurers in setting more accurate rates, as well as in reducing climate change uncertainty loads in pricing and capital management environments. The ACRI can also be highly useful for portfolio diversification purposes since it considers many components of climate risk. The ACRI evaluates the probability of a specific loss event such as a high-temperature event in a certain region, the amount of the exposures in that region, and how vulnerable those exposures are to a loss event (e.g., Texans are more likely better equipped to deal with a heat wave with resources such as air-conditioning, which Alaskans are less likely to possess). All of these ACRI features enable insurers to better quantify, diversify, and manage their risk.

Climate change signifies additional medium- to long-term uncertainty for the insurance industry. The ACI and ACRI are new resources that will enable actuaries to proactively deal with these future challenges. The ACI and ACRI can provide valuable insight into climate change and can be used in a variety of insurance applications like pricing and portfolio diversification. Actuaries cannot stop climate change, but they can keep doing what they have always done best—adapt and develop new methods to help the insurance industry continue to manage risk and thrive.

Tyler Shalitis | September 13, 2017