January Reinsurance Renewal Pricing Remains Stable

January 03, 2019

Both JLT Re and Willis Re recently released analyses outlining reinsurance pricing at the January 1, 2019, renewal. The organizations found that, on the whole, renewal pricing remained stable despite building pressures on the reinsurance market. For some specific lines, most notably property-catastrophe, rate increases have affected accounts with sizable losses or deteriorating accounts, while those with favorable loss experience have achieved flat renewals with some rate reductions.

Willis Re Report: 1st View Contrasting Realities

In its report, Willis Re said that reinsurance placements at January 1 highlight a pricing gap between accounts with peak peril exposures or poor loss records and those without, with many reinsurers placing emphasis on the quality of client counterparties.

According to Willis Re, the two-track trend has been especially evident in property-catastrophe renewals, where cedants with good loss records and a disciplined early renewal process achieved risk-adjusted rate reductions, while loss-impacted accounts and clients viewed as of lesser quality are seeing upward pricing across a number of lines.

Insurance-Linked Securities

Willis Re said the insurance-linked securities (ILS) market faces a more comprehensive test in the absence of a major pricing uptick following significant loss erosion for some funds in both 2017 and 2018.

Some funds are challenged in attracting new investors, per Willis Re, and those with long-standing and successful track records, consistent and well-regarded management teams, and flexible trust language or fronting agreements are the ones best equipped for success.

Other Factors

According to Willis Re, adjustments to business models initiated over the year have taken on increased urgency, including the well-documented changes within the Lloyd's market. The upshot is that some primary lines are seeing significantly larger rate increases than treaty reinsurance business.

Furthermore, the Willis Re report found that reinsurers have benefited from increases in premium ceded by large carriers, notably through large new pro rata cessions where terms have slightly tilted in reinsurers' favor. At the same time, major reinsurers' strength and client-centric flexibility remain key to large cedants' goal of dampening earnings volatility, said Willis Re.

James Kent, global CEO, Willis Re, said, "In the immediate aftermath of the 2017 catastrophe losses, many observers felt the measured reaction of the reinsurance market was a clear sign of a changing structure and maturity."

He continued, "Others more cautiously suggested time was needed to properly assess the impact of 2017 events. In the wake of the high loss activity during the second half of 2018, early renewal negotiations have proved prudent, while pricing in the primary market has given reinsurers some cause for optimism in light of the increased pro rata cessions from clients."

The full Willis Re report is available on the Willis Towers Watson website.

JLT Re Analysis

According to JLT Re, reinsurance renewals broadly defied early expectations of post-loss firming for the second consecutive year at January 1, as reinsurers' desire and ability to underwrite risks remained healthy overall. Market conditions nevertheless deteriorated in some areas as dampened reinsurer appetite, as well as increasing demand, was observed for business classes that suffered sizable losses or where performance has deteriorated in recent years.

Specifically, JLT Re said, a number of lines in the US casualty reinsurance market showed early signs of tightening as reinsurers navigated an uptick in loss ratios and an increase in the frequency of severe losses. Loss experiences were also acute in the property catastrophe market after a series of diverse and dispersed catastrophes in 2018—including Hurricanes Florence and Michael; Typhoons Jebi, Mangkhut, and Trami; flooding in Western Japan; and the Californian wildfires—cost re/insurers over $80 billion.

In addition, a number of large risk losses in several property and specialty classes occurred throughout the year, although abundant capacity generally offset upwards pricing pressures here, JLT Re said.

All in, according to JLT Re, 2018 registers as the 4th most costly catastrophe year ever in real terms and follows record insured catastrophe losses of $150 billion in 2017. Together, 2017 and 2018 constitute the most costly two-year period ever for insured catastrophe losses, although they are unlikely to come close to challenging the combined, inflation-adjusted, reinsured losses sustained in 2004 and 2005.

JLT Re Analysis: Renewal Outcomes

Global Market Property

JLT Re found that capacity constraints in the retrocession market dominated the January 1 renewal narrative. The quantum and timing of 2018 catastrophe losses were such that a sizable portion of retrocession capital, the bulk of which is provided by third-party investors, was trapped for a second consecutive year.

In addition, JLT Re said investor appetite softened in the 4th quarter, especially when compared to the same period in 2017. Appetite had been moderating throughout 2018 due to lower-than-expected returns and loss deterioration from 2017 events.

Many ILS funds, therefore, confronted a more challenging environment this renewal, as claims mounted from Hurricane Michael and the California wildfires, both of which were $10 billion–plus events, as well as Typhoon Jebi, the strongest typhoon to hit Japan in 25 years. A series of redemptions and a difficult round of fundraising followed, with lost or trapped capital not being replenished to the same degree as last year, according to the JLT Re analysis.

JLT Re said this contributed to an increase in retrocession rates by double digits on loss-affected layers at January 1, although the overall pricing picture was more nuanced than in 2018 as distinctions between occurrence and aggregate covers and traditional and ILS markets became more pronounced.

Bradley Maltese, deputy CEO of the United Kingdom and Europe, JLT Re, commented, "After another year of significant losses and locked capital in the retrocession market, rates for loss-affected catastrophe layers were generally up by between 10 percent and 20 percent on a risk-adjusted basis, with aggregate covers falling towards the upper end of this range."

He continued, "Many clean occurrence retrocession programs were renewed flat to up 10 percent. Global and Lloyd's direct and facultative (D&F) catastrophe covers were less affected by 2018 losses and, after strong increases at last year's [January 1] renewal, rate changes in 2019 were typically down 2.5 percent to down 7.5 percent on a risk-adjusted basis."

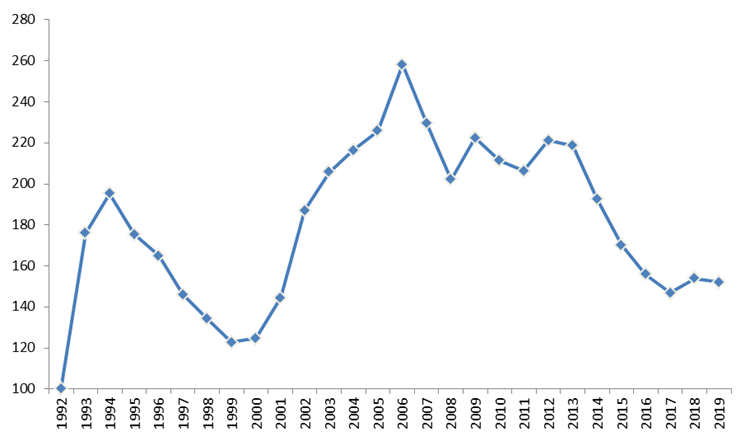

Reinsurance Property-Catastrophe

In its analysis, JLT Re found that spillover into the primary property-catastrophe reinsurance market was limited, possibly reflecting the relatively modest amount of loss-affected business up for renewal at January 1. Figure 1 shows that JLT Re's Risk-Adjusted Global Property-Catastrophe Reinsurance Rate-on-Line (ROL) Index fell by 1.2 percent at January 1, after increasing by 4.8 percent at January 1, 2018. This year's modest decline leaves the index below levels recorded in 2016. Indeed, the cost of property protection remains competitive with global property-catastrophe pricing, approximately 30 percent below 2013 levels.

Ed Hochberg, CEO, JLT Re in North America, said, "Despite another active catastrophe year in the United States, property-catastrophe rate changes were modest at [January 1]. Loss-free layers saw relatively muted movements, typically falling within a range of flat to down 5 percent."

He continued, "Strongly performing accounts renewed towards the lower end of this range as [cedants] argued (often successfully) that another clean year merited risk-adjusted decreases in 2019. Loss-impacted layers generally saw price rises, but outcomes varied depending on losses, geographies, exposures, and relationships."

Figure 1 below shows JLT Re's Risk-Adjusted Global Property-Catastrophe ROL Index—1992 to 2019. JLT Re's ROL index is risk-adjusted, meaning changes to exposures, as well as premiums, are incorporated.

(Source: JLT Re)

JLT Re's analysis found that sizable losses also occurred outside the United States in 2018, not least in Japan, but rate movements in Asia Pacific at January 1 generally saw single-digit reductions due to relatively benign loss activity in the territories that renewed on this date. Pricing pressures were negligible even in the few Asian markets that did sustain losses in 2018 (e.g., China with Typhoon Mangkhut and Indonesia with the Lombok earthquake). Another quiet loss year in Europe generally saw programs renew flat to moderately down on a risk-adjusted basis, according to JLT Re.

Casualty

The JLT Re analysis found that another major theme to emerge from the January 1 renewal was a more challenging environment in the casualty reinsurance market.

Keith Harrison, CEO UK & Europe, JLT Re, said, "A combination of increased severity, social inflation, and instances of adverse reserve development has seen reinsurance margins squeezed in a number of casualty lines."

He continued, "This led to more cautious risk appetites, downward pressure on ceding commissions, and some upward pressure on reinsurance rates. Specifically, commercial auto, professional liability, medical malpractice, per person workers compensation, and umbrella/excess casualty all experienced more challenging renewals than in recent years."

JLT Re found that mounting pressures were also evident for global casualty as loss-free programs renewed close to expiring levels while moderate increases were observed for loss-affected accounts. Similarly to 2018, these outcomes were often accompanied by lower ceding commissions, particularly for loss-affected programs.

Specialty

The analysis revealed that the specialty market typically saw strong levels of capacity offset any upward pricing pressures that came from successive years of rate decreases and rising loss trends. Most programs were broadly flat or slightly reduced in cash terms, which generally led to risk-adjusted outcomes ranging from flat to down double-digits. Results continue to be strong, despite the attrition fueled by certain large risk losses affecting the market in the second half of 2018.

Uncharted Territory

David Flandro, Global Head of Analytics, JLT Re, said, "Sustained capital inflows have offset mounting pricing pressures to bring relative stability to the reinsurance market over the last several years. Record levels of dedicated sector capital at year-end 2018 once again helped ensure continued, plentiful capacity across most lines at [January 1]."

He continued, "A small portion of excess sector capital was nevertheless absorbed in 2018 by sizable insured catastrophe losses in the second half of year, a reduction in third-party deployable capital, higher demand for reinsurance, and a renewed focus on underwriting discipline, as shown, for example, by reduced stamp capacity and higher capital requirements at Lloyd's."

Figure 2 below shows Dedicated Reinsurance Sector Capital and Gross Written Premiums—1998 to year-end 2018.

(Source: JLT Re)

JLT Re said that, significantly, its early analysis indicates that alternative capital growth in 2018 abated for the first time since the global financial crisis. This is consistent with the tightening observed in the retrocession market as some investors pulled back allocations due to what were perceived as disappointing returns throughout the year, continued loss creep from Hurricane Irma, and another series of costly catastrophe losses in 2018.

That said, JLT Re stressed that strong competition at January 1 ensured that capacity was only pared back in areas where major losses occurred or where return hurdles were not met.

JLT Re also asserted that this is a market which has clearly matured since the days when large catastrophes created massive price volatility. The reinsurance sector today remains exceptionally well capitalized, even at a time of macroeconomic change and unprecedented catastrophe loss activity.

Mr. Flandro concluded, "Loss experiences and the macroeconomic environment will play an important role in shaping the reinsurance market in 2019. Another large-loss year could test the limits of carriers' capital resilience, as well as investors' appetite for reinsurance at a time of capital market volatility.

"[Insurers'] balance sheets could also come under additional strain as the economic cycle shows signs of shifting for the first time since the immediate aftermath of the financial crisis. Reserving trends and asset leverage remain key sector drivers. After a prolonged period of low yields and disinflation, the specter of sudden movements in interest rates and asset prices bring important supply implications.”

To receive a copy of JLT Re's prospective market report, contact Isabella Gaster, head of communications and marketing at JLT Re.

January 03, 2019