3 Key Components to Managing a Successful Captive

Jeremy Colombik , Rosa Garcia | August 14, 2019

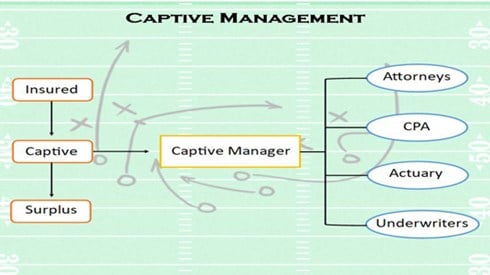

There are many different components involved in running a captive insurance company. While completing audits, filing tax returns, and tending to other regulatory compliance items are important, a captive insurer should also consider other key components to ensure its success. A successful captive is not merely a profitable captive but one that stands up to an Internal Revenue Service (IRS) audit and operates as an insurance company should.

Pricing

The first key component for success is ensuring that the insurance coverages the captive offers are priced at an appropriate level. To accomplish this, an accredited actuary should determine the policy premium. While a nonaccredited actuary can certainly develop the captive's policy premium, the cost savings resulting from not hiring an accredited actuary are not worth jeopardizing the program's integrity.

One of the first items the IRS looks at in an audit is how the captive premiums were calculated. Again, it is better to inform the IRS that an accredited actuary was relied upon for this. The actuary's pricing should be reasonable with easy-to-follow supporting documentation showing how the premium was calculated along with the rationale behind the pricing decision-making. The premium calculation should be done so that it would be supported under the review of another accredited actuary.

Premium Indication Letters

Premium indication letters maintain an important function for a captive insurance company and are the second key component to having a successful captive. Insurance companies big and small are required to send out premium indication letters. Since a captive is an insurance company and needs to run as an insurance company, it too must abide by this requirement. Often referred to as a "renewal letter," a premium indication letter will generally be sent out 3 months ahead of the insurance policy renewal date and frequently requests information such as the following.

- Has the company had any expenses for losses that were not covered under the current policy?

- Were the company's gross revenues decreased significantly?

- Are there any other risks, gaps in coverage, or policy exclusions that could harm the business?

A premium indication letter will also indicate the current coverage(s) provided by the captive, the coverage limits, and the premium amount required for each coverage. Furthermore, if the captive is operating as an insurance company, it will need to send out renewal letters to indicate if the insurance policy will be renewed, modified, or canceled.

Claims Management and Procedures

The third key component to a successful captive is claims management and procedures. When a captive is formed and issues insurance policies, it should also provide the insured with procedures on how to file a claim. As with any insurance company, claims are built into the captive insurance policy pricing and claims will arise that are covered by the captive policy. Effective claims procedures should have a step-by-step process for how to file a claim as well as a claims log to track the status of any claims, whether approved or denied.

The claims process should not be skipped when reviewing whether or not a submitted claim will be approved or denied for coverage under the captive policy. This has, and will continue to be, an area the IRS looks at when auditing a captive. One should also consider that while a captive may pay claims, the IRS could still find fault with the captive's claims management and procedures.

Some items that the IRS looks at when claims are paid include the following.

- Was a claim denied because it was determined not to be covered under the captive policy?

- Was the claim filed late in accordance with the policy provisions?

- Was the proper procedure followed in the claims process, or was the claim approved without following the claims process?

For all of the above reasons, it is vital for a captive to have claims management and procedures in place.

While a captive must consider many aspects to ensure that it is compliant, the aforementioned key areas are those that the IRS has brought up in recent court cases regarding captive insurance companies. Whether you are a captive owner, a potential captive owner, an adviser, a captive manager, or another service provider, following this advice will help support a successful captive endeavor.

Jeremy Colombik , Rosa Garcia | August 14, 2019