First Catastrophe Bond Issued Out of Singapore

March 01, 2019

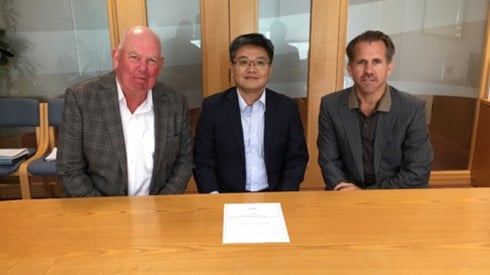

Insurance Australia Group (IAG) has sponsored the first catastrophe bond issued out of Singapore by Orchard ILS Pte. Ltd.

The bond provides IAG with AUD 75 million of annual aggregate catastrophe protection for three years and is part of its aggregate sideways cover, which in total provides protection of AUD 475 million excess of AUD 375 million.

GS Securities, a Guy Carpenter business unit, is the sole structuring agent and sole placement agent for the transaction.

In an article titled "Singapore to fund cat bond issuance costs, to develop ILS market," Artemis reported that Singapore has worked hard to ignite insurance-linked securities (ILS) and catastrophe bond transactions after it developed special purpose reinsurance vehicle (SPRV) regulations.

According to GS Securities, Singapore's regulatory system supports the incorporation of a Singapore-based purpose-built reinsurance entity (under the SPRV regulations) to securitize risks and also provides a tax framework that gives tax neutrality to the reinsurance entity and ILS investors.

The Monetary Authority of Singapore (MAS) introduced an ILS grant scheme in February 2018 to encourage ILS transactions in Singapore. The grant scheme covers the upfront ILS bond issuance costs, said GS securities.

Ng Yao Loong, assistant managing director, Development and International Group, MAS, said, "The IAG cat bond issuance is a significant milestone in the development of Singapore's ILS market."

He continued, "The (re)insurance industry, multilateral organizations, and sovereigns are now able to tap additional risk transfer mechanisms to better address Asia's disaster protection needs."

March 01, 2019