CIMA and NAIC Fortify Relationship To Coordinate Regulatory Efforts

August 17, 2018

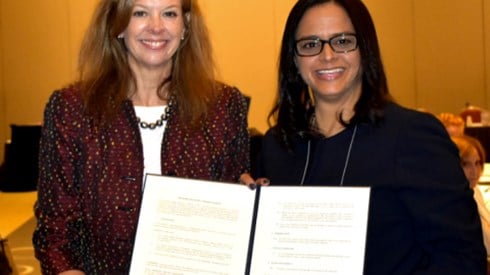

The Cayman Islands Monetary Authority (CIMA) has signed a memorandum of understanding (MOU) with the National Association of Insurance Commissioners (NAIC).

The MOU is designed to help insurance supervisors in the United States and the Cayman Islands coordinate on regulatory issues with the goal of efficient, fair, safe, and stable insurance markets. The agreement also encourages a formal framework to provide mutual assistance and exchange of information to assist in better understanding and coordinating compliance with applicable laws, regulations, rules, and requirements in each jurisdiction.

CIMA said in a statement that, over the years, it has established good working relationships with various state regulators within the United States and other regulatory standard-setting bodies outside of the Cayman Islands. To date, CIMA has entered into 55 bilateral agreements and 6 multilateral agreements with regulatory authorities, including the International Association of Insurance Supervisors and US Banking regulators (Federal Reserve System Board of Governors, Office of the Comptroller of the Currency, Federal Deposit Insurance Corporation, and Office of Thrift Supervision).

Cindy Scotland, managing director of CIMA, expressed that the signing of the agreement is another significant milestone in their ongoing collaboration with the regulators of the world's largest insurance market. "I am confident that this agreement will strengthen the relationship between the NAIC and the Authority. It will also provide stronger capabilities for each organization to achieve our common goals of economic stability and consumer protection," said Ms. Scotland.

Earlier this year, Julie Mix McPeak, NAIC president and Tennessee commissioner of commerce and insurance, said, "NAIC and its members are … working to develop global standards for insurance supervision and address systemic risk in a manner that is practical, flexible, and appropriate for insurance activities. The NAIC's sustained global engagement ultimately helps strengthen insurance markets in the U.S. and abroad."

To view a copy of the MOU, select the following link: NAIC—Memorandum of Understanding.

Above, President and Tennessee Commissioner of Commerce and Insurance Julie Mix McPeak (left) and Managing Director of CIMA Cindy Scotland (right) complete the signing of CIMA's newest MOU between the NAI and CIMA. Photo courtesy of CIMA.

August 17, 2018