You Own a Captive Insurance Company, Now What?

Jeremy Colombik , Amye King | June 25, 2018

Congratulations, you have become a captive owner, now what? Wouldn't it be great if there was a "what to expect" manual filled with must-have information, advice, insight, and tips? In your business, you set goals and have expectations for how things should be running. With a captive insurance company, it is the same situation. You and your captive manager have set goals in forming a captive, and you will now both manage an insurance company owned by you. It is important to know what to expect from your captive manager as you both oversee the company to ensure it is running in a profitable manner and in full compliance with your chosen captive domicile's laws and regulations.

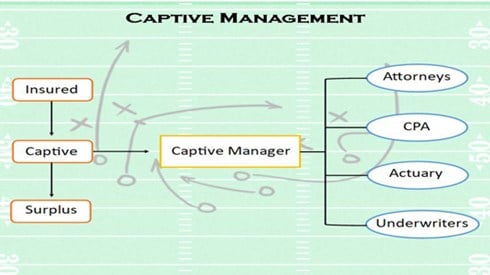

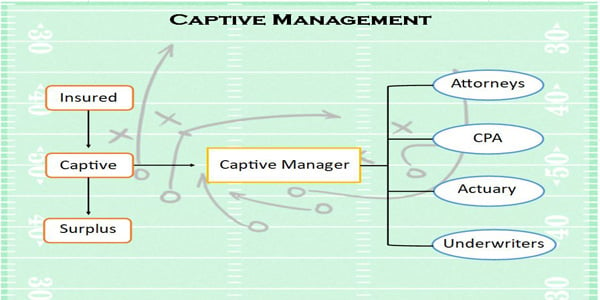

To gain a solid understanding of what to expect with your captive, it is crucial to first understand that running a captive insurance company involves many moving parts including the following.

- Regulatory compliance

- Claims procedures

- Financial reporting

- Shareholder statement reviews

- Relationship management

Overseeing a captive is comparable to managing a football team where the goal is to build the best team possible to achieve success. In this analogy, the captive manager plays the quarterback position, and the captive owner's job is to recruit a seasoned, successful captive manager. The captive manager is responsible for handling, implementing, and administering your captive program. The playbook for knowledgeable and experienced captive managers typically incorporates a turnkey approach so you, as the owner, can focus your attention on growing the primary business.

Expect Communication

Business owners may not spend a lot of time thinking about their risk management program as they work to lead and grow their primary company. It is not uncommon for businesses to think about insurance only before it is time to buy an insurance policy or submit a claim. This is where having a well-chosen captive manager makes all of the difference. A good captive manager will get to know you and your business and will make decisions regarding ongoing operational needs that help you achieve your business goals. As the captive insurance program manager, your captive manager should be fully transparent in all communications and maintain trusting and solid relationships with your captive's team of actuaries, lawyers, underwriters, certified public accountants (CPAs), claim specialists, and regulators.

An agile captive manager should be knowledgeable about all captive industry changes and developments surrounding federal and state laws and must be ready to adjust to any new rules, regulations, and requirements affecting any member of the captive team. They should not only be equipped with the latest information, but they should keep you informed of the same. An efficient captive insurance company relies on a captive manager that invests in its relationships with the key captive team players and keeps the entire team, including the captive owner, well-informed.

Expect Accessibility

As part of the team, you should expect to have accessibility to your captive manager. With proper communication channels in place, a winning captive program also demands an accessible and dedicated captive manager. Your calls, emails, and questions should have a timely response within 24 hours. While it may take more time for your captive manager to assemble a full answer, a dedicated captive manager should acknowledge your communication within 1 or 2 business days.

In addition to responding to inbound communication from you, how often do you hear from your captive manager: monthly, quarterly, annually? Most experienced captive managers will proactively send out newsletters, at least once a year, informing their clients of any changes and updates in the captive market. Other important, timely client communications should include but are not limited to quarterly statements and premium renewal letters.

Expect Proactive versus Reactive Program Management

A captive is an insurance company and must be operating as such. While all seasoned and successful captive managers should stretch and innovate to meet their clients' needs and goals, the bottom line is that a captive is a regulated entity that must comply with all state, federal, and local domicile laws, rules, and regulations.

As previously mentioned, it is imperative that your captive manager stays up on changes within the captive insurance industry as well as the larger insurance industry. This includes keeping track of changes in the law, Internal Revenue Service notices, and market fluctuations on coverages, to name a few. A well-informed and nimble captive manager will assess the immediate implications of such changes and will fine-tune the program's moving parts accordingly. In conjunction with this, a proactive captive manager will plan accordingly to implement any captive program changes needed in the future to ensure a seamless, long-running captive program.

Expect Updates on Procedures and Regulations

As stated earlier, your captive manager should keep you informed. This includes keeping you informed about what it does behind the scenes. For instance, when you form a captive and insurance policies are issued, you should also receive claims procedures on how to file a claim and a summary of important captive deadlines including but not limited to tax returns, audits, and state filings. Expect to obtain a clear procedure describing all of the processes your captive manager is undertaking on your behalf. In addition to this, while your captive manager is ultimately responsible for ensuring your captive follows all applicable laws, it is important to obtain from them the proper information so that you can gain a basic understanding of what this involves.

Expect Positive Results

If done for the right reasons, captives can be a great business solution. A compliant and efficient captive program starts with putting in place the right captive manager as your "quarterback" to assemble and oversee your captive's team. With well-informed and transparent processes that adhere to all pertinent laws, claims can be timely processed when they occur. The best way to check the performance of your captive manager is to look at your captive program's performance. While each captive program's goals and outcomes will vary, the greatest result is seen when a captive forms and develops to embody the expectations set in the early stages by its owner and its captive manager.

Jeremy Colombik , Amye King | June 25, 2018