Florida Property Reinsurance Renewal Pricing Is Highly Competitive

June 05, 2018

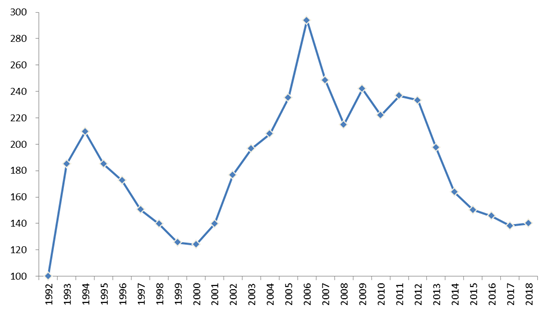

The latest JLT Re research shows that low single-digit reinsurance rate increases for the June 1, 2018, Florida property-catastrophe renewal have not met early market expectations. JLT Re's risk-adjusted Florida property-catastrophe rate on line (ROL) index increased by 1.2 percent this year, the first rise in 7 years (see Figure 1). This compares to a 5.1 percent rate reduction last year.

Despite a greater number of loss-affected programs renewing after Hurricane Irma's landfall in Florida last year, the June renewal did not match the rate increases recorded for US property-catastrophe business at January 1, 2018. As a result, pricing for Florida property-catastrophe business remains 40 percent down on 2012 levels and only 13 percent above the previous cyclical low of 1999/2000.

Markets continued to prioritize better performing cedants during the Florida renewal, focusing on underwriting and claims handling. Although Irma had a relatively muted impact on pricing, it did allow reinsurers to assess cedants' post-event capabilities.

Brian O’Neill, executive vice president at JLT Re (North America) Inc., said, "Renewal experiences in Florida were wide-ranging, with some cedants' loss-affected layers seeing risk-adjusted rate increases in the mid-to-high single-digit range. Cedants who had demonstrated strong post-event capabilities clearly benefited from the additional capacity in the market. Rate increases for loss-impacted layers were muted, while in some cases, loss-free layers were even down modestly. Overall, the renewal was highly competitive, reflecting abundant capacity and only moderate increases in demand despite the market suffering its most expensive catastrophe loss year on record in 2017."

Figure 1: JLT Re's Risk-Adjusted Florida Property-Catastrophe ROL Index

1992–2018

Source: JLT Re

According to JLT Re, given the rapid reload of alternative capital following these events, insurance-linked securities (ILS) markets were vigorously looking to deploy capital at the Florida property-catastrophe renewal. Significantly, there was some evidence through the renewal process of ILS players extending provisions into areas traditionally dominated by traditional reinsurers, such as reinstatements. In doing so, they proved to be as competitive on price as the traditional market, with single-shot transactions such as top or drop aggregate cover and reinstatement premium protection occasionally coming in cheaper.

JLT Re said this put traditional reinsurers under pressure to defend market share. These competitive conditions were not unexpected due to the overabundance of capacity at the January 1 and April 1 renewals, which already suppressed rate increases and prevented the type of market reaction that had followed other large-loss years. Specifically, price momentum in the retrocession market has receded through the course of the year, and given its historical correlation with the Florida property-catastrophe market, traditional reinsurers were prepared for the environment they confronted at June 1.

Looking forward, amidst some instances of adverse development for Irma, markets will be closely monitoring loss adjustment expenses and scrutinizing any further signs of attritional loss and/or assignment of benefits issues.

Supply Glut

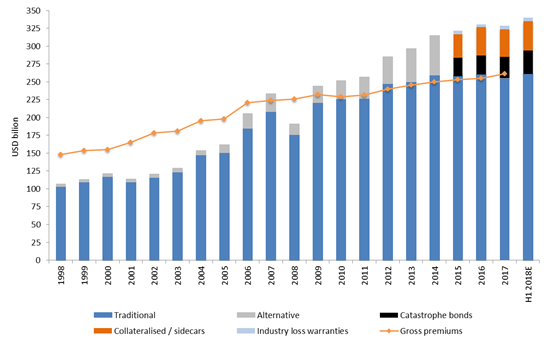

Abundant reinsurance capital continues to dominate the reinsurance market. JLT Re estimates that dedicated sector capital will be at record levels by the end of the first half of 2018, recovering strongly from the modest dip sustained last year after the $140 billion plus of insured catastrophe losses (see Figure 2). The result is a continued supply and demand imbalance and a market awash with capacity.

David Flandro, global head of analytics at JLT Re, said, "Dedicated reinsurance sector capital has been very strong with growth of over $10 billion during the first half of 2018, following roughly $7 billion of new capital raised in the final four months of 2017. This affirms the now established trend of third-party capital rapidly entering the sector post-loss to fill the gap more or less immediately. The effects of this were evident in the intense competition at June 1 between alternative and traditional markets culminating in negligible rate rises despite Florida having recently suffered its first landfalling hurricane since 2005. This is a significant contrast to previous large-loss years, which were all followed by significant—often double-digit—rate increases. It is now obvious that the means through which the sector raises capital at the margin have completely changed over the last decade, with huge implications for property-catastrophe reinsurance pricing and underwriting in particular."

Figure 2: Dedicated Reinsurance Sector Capital and Gross Written Premiums

1998 to

H1 2018

Source: JLT Re

Prospects for the Remainder of 2018

JLT Re reports that the first 5 months of 2018 have provided carriers with some respite, as catastrophe losses have been relatively light. Therefore, all eyes are now firmly fixed on this year's hurricane season. Some early season forecasts pointed to above-average activity, although downward revisions have been made in the latest rounds of updates due to unseasonably cold waters across the tropical Atlantic and Caribbean and the possibility of a developing El Niño towards the end of the season. Whatever the outcome, the reinsurance market is strongly positioned to deal with any potential losses.

The reinsurance market has responded extremely well to the substantial losses sustained during last year's hurricane season. Despite the significant costs associated with Irma, single-state carriers in Florida emerged relatively unscathed from their first major test, thanks in large part to the reinsurance protection they purchased. Buyers' needs were adequately met at June 1, and more of the same is expected through the remaining mid-year renewals and into 2019. The value and efficiency of reinsurance protection is once again being demonstrated by allowing cedants to react speedily to underwriting opportunities.

June 05, 2018