Widening Terrorism Re-insurance Coverage Availability Crucial for Resilience

May 04, 2018

JLT Re's latest report, Terrorism Re/insurance: Achieving Resilience, analyzes the dynamics behind the evolving terrorist threat and examines how the terrorism re/insurance market has reacted. JLT Re advises that although significant progress has been made, there is still more to do in order to deliver a sustainable proposition that offers comprehensive protection to buyers.

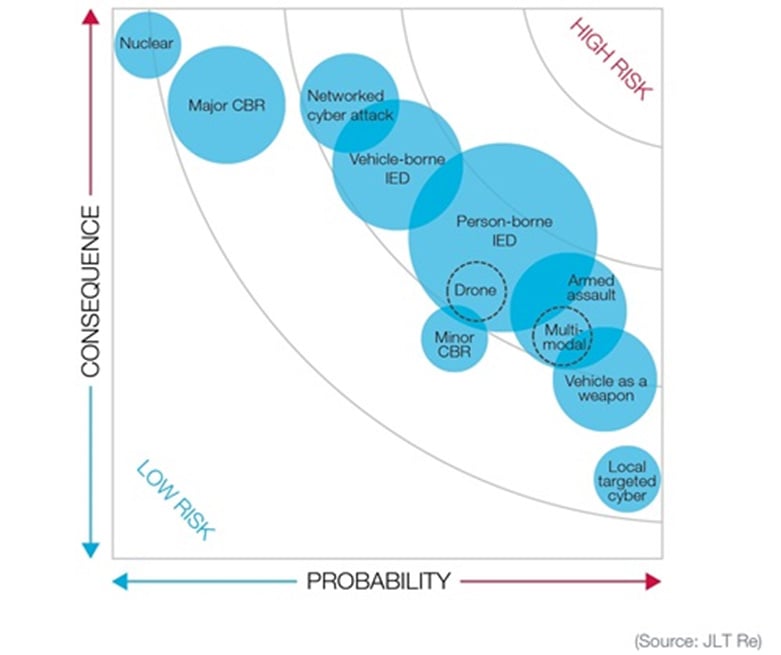

The illustration of today's threat landscape in Figure 1 below shows why this is the case. New terror-related risks are surfacing around impacts on people, loss of attraction, cyber, and toxic agents. At the same time, terrorist groups continue to harbor ambitions of launching major attacks, which means that substantial property damage remains a real danger. Further attacks are almost inevitable in the West, with wide-ranging threats emanating from so-called Islamic State returning fighters from Syria, an empowered al-Qaeda, and even quasi-state actors or proxies (with the latter raising serious questions about attribution). The threat from nationalist/separatist movements, right-wing extremism, and other extremist groups also should not be underestimated.

Figure 1: Terrorism Threat Landscape in 2018

Raj Rana, head of war and terrorism at JLT Specialty, said, "The impact of these shifting risk dynamics on businesses and the insurance terrorism market has been significant. In recent years, we have seen major terrorism losses suffered by clients in situations where they were not the primary target. With property damage no longer necessarily the main loss driver, the limitations of traditional terrorism products are being exposed. As our report shows, a number of specialty insurers have responded robustly to buyers' calls for wider cover with an impressive array of new products being launched in the last two to three years, including threat, loss of attraction, active shooter, malicious attacks and cyber."

Stephen Hudson, senior terrorism consultant at JLT Re, added, "The progress made to date by the primary market represents a major step forward in narrowing terrorism protection gaps. As the ground swell for such cover grows, pressure is building on the terrorism reinsurance market to provide new solutions for the more dynamic primary carriers. This is compelling reinsurers to broaden risk appetites and adopt new approaches to account for the complexities that the new threat landscape brings. The role risk advisers play in developing sophisticated modelling and analytics tools, and communicating their results to risk carriers, will be crucial in bringing about this change. Broad cohesive cover supported in depth by the market will achieve greater resilience for insureds, the market and the wider economy."

But more still needs to be done, according to JLT Re. Specifically, capacity for new forms of cover in the standalone market continues to be relatively modest when compared to more conventional terrorism risks. Perhaps even more importantly, awareness of the new coverages on offer needs to be extended beyond sophisticated buyers familiar with the intricacies of the insurance market.

While the process of creating new products to mitigate evolving risks is pivotal, said JLT Re, more consideration needs to be given to marketing and distribution channels to better target small and medium-sized enterprises (SMEs). Fewer than 5 percent of small businesses in the United Kingdom, for example, are currently estimated to have terrorism insurance. And those SMEs that have purchased traditional cover risk being left exposed given recent attacks have highlighted considerable protection gaps around nondamage business interruption losses in particular.

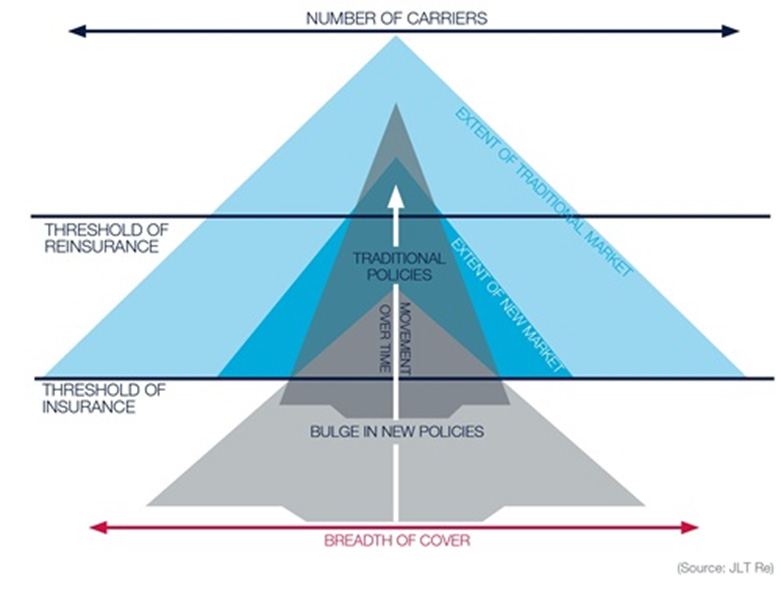

JLT Re believes that making new terrorism coverages available to SMEs is, therefore, crucial. Ultimately, this will help propel demand for re/insurance and make economies more resilient to future attacks. Figure 2 below explains how increased take-up could impact the market. As awareness of these coverages grows, more capacity will be required, forcing other primary and reinsurance insurers to catch up with the innovators that have led the charge so far.

Figure 2: Terrorism Market Penetration

JLT Re also said that state terrorism pools are also likely to be crucial in facilitating greater awareness and accessibility. Pools have a unique opportunity to increase penetration given their scale and influence in the market, along with the direct distribution channels they have built. In fact, pools in certain countries have already taken bold steps to narrow protection gaps by expanding the scope of their original remits and extending coverages to include nonproperty damage losses, as well as incorporating new risks such as cyber. Over time, this is likely to stimulate further competition in the private market and increase the supply of new forms of cover.

May 04, 2018