KBRA's Unique Global Captive Insurer Rating Methodology

November 27, 2017

On November 1, 2017, Kroll Bond Rating Agency, Inc. (KBRA), released its Global Captive Insurer Rating Methodology. In an interview with Carol Pierce, director—insurance, Captive.com got an in-depth introduction to the key criteria KBRA will be looking at when it rates a captive. The following is a transcript of the discussion.

So, Carol, let's start by having you explain what types of captives you will be rating under your new methodology.

For the methodology to apply, a captive must meet two criteria, as follows.

- It must primarily underwrite insurance risk for its owner, and

- It must be licensed and regulated under its domicile's captive legislation.

This would include single-parent captives, group or industrial captives, association captives, branch captives, agency captives, and even micro- or 831(b) captives since KBRA has no size bias. It includes those risk retention groups that are licensed and regulated as captives. For those that aren't, our Global Insurer and Insurance Holding Company Rating Methodology would apply. To the extent allowed by the regulator, the methodology applies to captives underwriting third-party business.

KBRA intentionally set the criteria to follow how each domicile defines a captive.

But you didn't mention cell captives. Most domiciles have some form of cell captive included under their captive laws. Are cell companies covered under your methodology?

Just the traditional types of captives are covered by this methodology. However, we are exploring a separate methodology to address the unique legal issues presented by cell company structures.

OK, that's good to know. So, how does KBRA's rating scale compare to the other rating agencies?

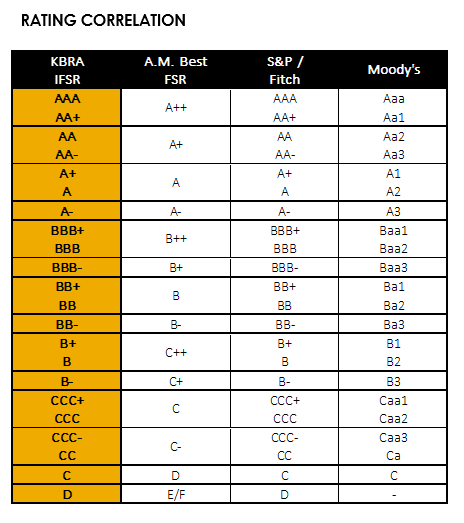

KBRA's insurance financial strength rating (IFSR) scale is consistent with the capital markets, or AAA, scale with which chief financial officers and the investment community are most familiar. Here's a side-by-side comparison.

Thanks, that's very handy. So, what exactly is KBRA's process for assigning an IFSR to a captive?

The process is pretty simple. The IFSR process is intended to capture the financial and operating risk to the policyholder(s) of the captive and, ultimately, to indicate the likelihood that the captive will be able to meet its policyholder obligations over the long term. KBRA's process is designed to be the ideal blend of quantitative and qualitative analytics. We truly believe that we have developed a methodology that is both comprehensive and yet flexible enough to evolve with the captives and the captive industry over time.

So, I like pictures. This is a graphic representation of the four sequential steps in KBRA's rating process.

Step 1 is our quantitatively based captive quantitative assessment, or CQA. This is expressed in lowercase letters using KBRA's long-term credit scale. After the application of stress testing, the CQA is converted to a preliminary credit assessment, or PCA, using the IFSR scale.

For Step 2, we overlay a thorough, qualitatively based evaluation. This encompasses factors that may have financial underpinnings but contain some subjectivity. These include the major categories of balance sheet management, operating fundamentals, and captive profile and risk management.

Step 3 is external considerations. This is the step in the process that incorporates KBRA's formal assessment of the owner(s). It could result in potential credit support due to the strategic importance of the captive and the owner's ability and willingness to financially support the captive when needed. Or it could have a negative impact due to the owner's lack of ready sources of additional capital should the need arise.

The final stage, Step 4, is a potential rating constraint due to sovereign risk; in particular, transfer and convertibility risk.

So, to reinforce what I said before, our analysis of captives is a true combination of quantitative and qualitative elements.

Can you tell us a bit more about the captive quantitative assessment? What ratios are you looking at, and which ones are most important?

The CQA pretty much sets the foundation for the overall rating evaluation. In this step, we calculate a series of financial metrics that are based on the audited financial statements of the captive, generally accepted accounting principles or IFSR, in general. We look at net leverage, ceded reinsurance leverage, business retention, dividend ratio, combined ratio, investment income ratio, operating ratio, return on equity and revenue, overall liquidity, operating cash flow—the usual metrics used to analyze a risk-bearing entity.

It's important to note that the CQA is intended to be an issuer-level assessment representing a first-cut view of the stand-alone risk of the captive. So, the parent company is considered later in the process.

We compare the ratios I mentioned to those of a selected peer group. Based on the distribution of results for each ratio, the CQA score is calculated with each ratio getting an equal weighting.

You don't mention output from a capital model as one of the ratios that the analyst considers in the quantitative assessment. Does KBRA have its own capital model? If not, how do you assess capital adequacy?

No, KBRA does not have its own proprietary capital model. We decided not to employ an internal capital model for several reasons—most notably because we recognize that all captive organizations/structures are different. So, we believe that thorough, detailed analysis—without reliance on a capital model—facilitates transparent and accurate ratings.

Instead, a key part of the quantitative assessment is stress testing!

We apply a series of stress tests to incorporate potential, forward-looking risk scenarios that are not typically factored into the quantitative analysis. These tests provide a powerful tool to determine the sensitivity of a captive's current stand-alone financial position and its ability to maintain its long-term financial strength under duress. Our stress testing starts with a probability of ruin analysis because, as I've already mentioned, we are looking at the stand-alone risk of the captive in Step 1.

Stress testing may also include the impact of financial market events, especially for captives with extensive or nontraditional investment portfolios. We will request detailed data on the captive's loss reserves and, where warranted, its investment portfolio in order to improve the results of the stress testing.

For captives with natural catastrophe exposure, KBRA will typically stress test capital for severe windstorms and earthquakes. We will examine any models used by the captive including their own array of stress scenarios and incorporate into our analysis as appropriate. Ultimately, we expect our assigned ratings to withstand moderate levels of stress over the near-to-medium term.

The application of stress testing may lead to an adjustment to the CQA. In addition, we may adjust the CQA to incorporate current, or planned, uses of the captive not reflected in the historical quantitative analysis. Once all this is factored in, we reach a preliminary credit assessment.

How does the qualitative evaluation factor into the process?

Our qualitative evaluation focuses on three key rating determinants, as follows.

- Balance sheet management

- Operating fundamentals

- Captive profile and risk management

For the most part, the basis for our qualitative evaluation is the face-to-face meeting with the captive's team. It is important to note that we plan to meet every captive we rate. We prefer to meet not only the captive owner but to have conversations with the various service providers—actuary, investment manager, captive manager, etc.—basically, do anything we can to gain a full understanding of the captive, its role in the risk financing strategy of its owner(s), and its risk culture and overall appetite.

In this table, you can see that each of the three rating determinants has a number of sub-determinants, for a total of 12 categories that are evaluated. For each sub-determinant, the analytical team decides whether that particular factor has a favorable, neutral, or unfavorable impact on the credit profile of the insurer. Specifics as to what guides these evaluations are outlined in three rubrics, one for each rating determinant, in the methodology document.

Can you provide a quick example?

Sure. So, for the Current Year Profitability sub-determinant, the rubric looks like this.

Even though captives are not generally profit oriented, this factor is still important and can have a favorable impact on the captive's credit profile. Where necessary, we bifurcate the captive's source of earnings into those emanating from its "own risk" and those from third-party risk. A single-parent captive that writes no third-party risk whose cost of risk for its own exposures is lower than its peers, according to the latest RIMS Benchmark Survey™, likely would get an assignment of +1. In contrast, the evaluation may be unfavorable if there is meaningful unfavorable reserve development. So, if this sub-determinant is deemed to be unfavorable, it will be scored a –1.

That's certainly a different approach to captive profitability! Is KBRA also unique in its treatment of letters of credit (LOCs) and loan-backs that many captives have?

KBRA views LOCs and intercompany loans on par with any other asset. They get factored into the qualitative assessment under the Asset Quality and Investment Risk sub-determinant under Balance Sheet Management. KBRA examines the quality of the LOC and assesses the financial strength of the issuing, or confirming, financial institution. For loans, we assess the credit quality of the counterparty. Our assessment of these, and other, assets focuses both on concentration and liquidity and any impact on the captive. So, a captive whose assets consist solely of cash and a loan-back to a parent company would likely be scored 0, provided the loan agreement allowed for immediate funding and carried a reasonable interest rate. No penalty!

So, to recap what we've covered so far, at KBRA we place material importance on performing deep dives and thorough reviews of all companies that we rate. We understand and recognize the unique characteristics of captives. That's why we issued an entirely separate rating methodology for captives.

We review the 12 sub-determinants as part of the iterative and interactive rating process. The individual sub-determinants carry equal weight within the adjustment score, but as you saw in the table balance sheet management comprises 50 percent of the sub-determinants. Also, as highlighted in the methodology, we do have the ability to adjust the determinant and sub-determinant weights in certain circumstances to account for unique situations and other nuances that the analytical team deems appropriate.

This subjective process cannot be thought of as independent from the quantitative analysis that culminates in the PCA but rather as an overarching analysis of the captive and a key component of our credit opinion. In completing our analysis, and corresponding to our rating methodology, we intend for our analysis to be forward looking, inclusive of projections and estimates. As an aside, this step plays an important role in reviewing newly formed captives.

So, let's make sure our readers understand you correctly. Does this methodology also apply to start-up captives?

Yes, it does. KBRA determined that it was not necessary to have a methodology specifically dedicated to newly formed organizations. For captives that are just starting out, we will use our Global Captive Insurer Rating Methodology as it was intended to include them. Since these entities do not have historical financial information, the analysis will be focused on the qualitative aspects of our process—emphasizing the owner's reasons for captive formation, reasons for domicile selection, and the reasonableness and feasibility of the business plan. The type of information we would review includes the following.

- A detailed approved business plan with projected financial statements for at least 5 years

- Initial capitalization amount and capital structure

- Use of reinsurance, financial, and/or operating leverage

- Detailed information on owner(s) and our assessment of how committed, and able, they are to support the captive

- Pricing methodologies and underwriting practices

- Risk appetite statements and risk tolerances

- Investment managers and initial allocations, if applicable

Clearly, this is not an exhaustive list.

I just want to emphasize that we do not have seasoning or minimum capital levels to be eligible for a rating. We will rely on our decades of experience rating all types of insurance entities as to the risks of the underlying business and evaluate the associated reserves, capital, and financial flexibility of the new organization.

Let's move on to Step 3, external considerations, where you said that KBRA would formally assess the captive owner(s). What's involved here?

The review for single-parent captives will be performed by KBRA typically utilizing our General Corporate Rating Methodology. We are not going to get into the details of that methodology here, but suffice it to say that this step cannot be waived! It can, however, range from a credit estimate based solely on publicly available financials that we incorporate—behind the scenes—into the captive IFSR to a published, monitored rating on the parent company using our long-term credit scale. Obviously, the more interaction, the more robust the result that will get incorporated into the captive's IFSR.

External considerations could potentially result in multiple notch adjustments of the Intermediate Credit Assessment either upward or downward based on our view on the credit quality of the parent and the level of support that the parent provides.

On the other hand, our review of the parent may cause the analytical team to determine that additional risks are present outside of the captive that may impact its ability to pay policyholder claims in the long term.

And what about group captives or risk retention groups? Does Step 3 apply to them as well?

Yes, it does. For group captives, the review in this step of the rating process will focus on the availability, and perceived adequacy, of any explicit assessment features in the captive's bylaws or policies or any implicit support based on the creditworthiness, and willingness, of a sponsoring organization to financially support the captive, when needed.

One last comment on external considerations before your next question. The credit assessment of the parent does not act as a ceiling to the captive's IFSR. The captive's rating may be higher than the parent's, provided the stand-alone credit metrics warrant and there are appropriate safeguards in place.

Can you quickly take us through the final step in the rating process—sovereign risk?

KBRA's credit ratings incorporate sovereign, or country, risk in the rating process for financial institutions, including captives. KBRA's approach to rating sovereign debt is outlined in our Sovereigns Rating Methodology. This methodology highlights that sovereign debt ratings do not act as a ceiling for insurers domiciled in a country. We evaluate each insurer to determine its susceptibility to the same macro conditions that impact the government's debt-paying ability as well as its susceptibility to transfer and convertibility risk, another important source of credit risk. To the extent that a captive is subject to the same risks as the sovereign, KBRA IFSRs may be constrained.

One final question for you, Carol. Can you talk a bit about the Rating Committee and the process?

At KBRA, we have two primary committees: the Rating Committee and the Credit Policy Committee. The Rating Committee is highly focused; it is convened to review, assign, or change a rating. The purview of the Credit Policy Committee is much broader, including all other matters pertaining to the procedures, methodologies, criteria, models, and other infrastructure necessary to determine, disseminate, and monitor ratings.

In any event, you're probably more interested in the Rating Committee process. The purpose of a Rating Committee is to provide a formal forum for active participation and the sharing of multiple points of view. The lead analyst responsible for the rating, in consultation with his or her manager, can convene a Rating Committee at any time. The lead analyst will provide a Rating Committee memo outlining the proposed rating, or rating action, and supporting information.

To achieve a quorum, a Rating Committee must have at least three voting members, one of whom must be a managing director or above. All committee members are checked for potential conflicts of interest before any work is started on the credit and then again at the beginning of the Rating Committee meeting.

November 27, 2017