Pricing Improvement Expected for P&C Insurance and Reinsurance

November 22, 2017

Prices in non-life insurance and reinsurance are expected to increase, according to Swiss Re Institute's Global Insurance Review 2017 and Outlook 2018/19 report. The multiple large natural catastrophe events that occurred in the second half of 2017 have drained capital from the property-casualty (P&C) sector. Simultaneously, prices have been low, having fallen substantially over the past several years. The global economy is in a cyclical upswing, and the forecast is for moderate growth in 2018 and 2019. This should further support growth in the insurance markets, with global non-life premiums forecast to rise by at least 3 percent in real terms annually in 2018 and 2019. The emerging markets, particularly in Asia, will continue to be the main driver of premium volume gains.

The string of large natural catastrophes in the second half of 2017—Hurricanes Harvey, Irma, and Maria as well as earthquakes in Mexico and wildfires in California—resulted in significant losses in P&C insurance and reinsurance. The three hurricanes and earthquakes in Mexico resulted in estimated insured losses of $95 billion, and non-life re/insurers' full-year underwriting results are likely to be severely impacted. For example, the combined ratio in US P&C insurance for 2017 is forecast to rise to 109 percent from 101 percent in 2016. In global reinsurance, assuming no further large catastrophe events, the combined ratio for this year is estimated to be around 115 percent, up from 92 percent in 2016.

The large losses are expected to lead to rate hardening in both non-life insurance and reinsurance.

"Price rises in loss-affected segments are already happening and could be substantial," says Kurt Karl, Swiss Re's group chief economist. "The ultimate volume of losses is not yet known, but appears to be large enough to cause price increases beyond the affected sectors. This is also happening because prices have fallen so low over the past few years."

In reinsurance, the above-mentioned catastrophes have drained capacity from both the traditional and alternative capital sectors. Prices in loss-affected accounts could rise significantly.

Global Economy Is in a Cyclical Upswing

Growth momentum in the global economy improved in 2017, and moderate growth is forecast for 2018 and 2019. In the United States, gross domestic product growth is expected to remain steady at around 2.2 percent in 2017 and 2018. The euro area is forecast to grow by around 2 percent this year and next before slowing in 2019. The Chinese economy grew by an estimated 6.8 percent in 2017, with an anticipated slowdown to 6.2 percent by 2019. Inflation has been moderate in most countries, although it is expected to move gradually higher in the United States. Overall, interest rates are expected to remain low. In the United States and the United Kingdom, the central banks are forecast to raise policy rates gradually over the next couple of years and, as such, long-term government bond yields are projected to rise modestly (for example, to 3.2 percent in the United States by the end of next year).

A number of risks could derail this relatively benign growth outlook. For example, protectionist trends pose an increasing threat to global economic growth. Also, there are worries that unwinding of quantitative easing programs by central banks could spark a negative financial market reaction. In addition, elevated corporate debt levels in China, despite measures taken, remain a concern.

Non-Life Insurance Premium Growth To Remain Steady

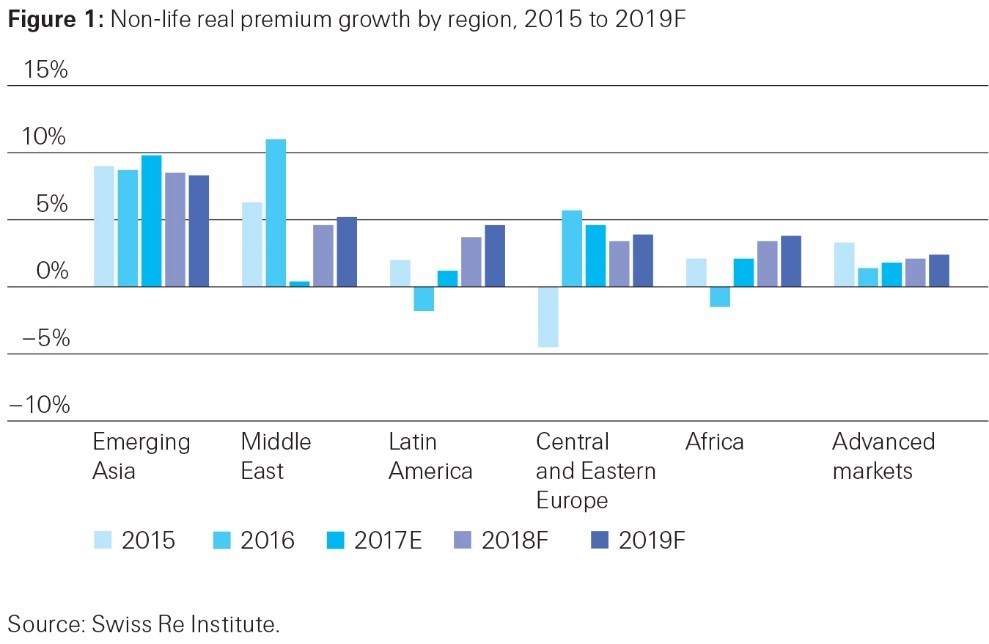

The improved economic outlook is expected to boost demand for non-life insurance. Global non-life insurance premium growth is forecast to be at least 3 percent in 2018 and 2019 and could be substantially higher, depending on the magnitude of the expected price increases. Emerging markets will continue to be the main driver of growth, with premiums forecast to rise by 6 percent to 7 percent in real terms annually over the next 2 years, little changed from 2017. The overall emerging market non-life premium growth reflects the stabilizing economic conditions in most regions. In addition, non-life business will continue to benefit from urbanization and rising home and car ownership. Concerns about environmental protection, food safety, and underinsurance in property are also expected to filter through to a sturdier demand for associated liability and property covers.

Global non-life insurance industry profitability has declined in 2017, with return on equity (ROE) down to 3 percent from 6 percent in 2016. The decline was driven by three main factors: soft underwriting conditions, low investment yields, and catastrophe losses. Insurers' investment income has continued to be weak given the ultra-low interest rate environment over recent years and will not recover soon. As interest rates gradually rise, investment income will grow only slowly, with a lag to rising rates. As such, while profitability in non-life insurance is expected to strengthen in 2018 and 2019 as underwriting conditions turn more favorable, the improvement will be modest with industry ROE at around 7–8 percent.

In non-life reinsurance, global premiums are estimated to have grown by 3 percent in 2017 in real terms, based on rapidly increasing cessions from emerging markets. In 2018 and 2019, premium growth in emerging markets is expected to remain steady, driven by stronger sales of primary insurance in all regions. In the advanced markets, premium growth will reflect a moderate hardening of rates and stronger primary market growth.

Access the data from the study. This mobile-enabled Web application allows users to create charts, share them via social media, and export them as standard graphic files. Order the study by email.

November 22, 2017