Accounting Rules Impact Captives Writing High Deductible Workers Comp Policies

Kia Bickel | September 20, 2017

Editor's Note: Revisions to Statement of Statutory Accounting Principles (SSAP) No. 65 regarding high deductible policies have been a hot topic for insurance companies this summer. Johnson Lambert has recently released a new white paper on these revisions. Any captive insurers using this type of policy need to be aware of the changes and their impact. Below, Captive.com has reprinted the entire white paper with permission from Johnson Lambert.

After a series of recent insolvencies involving workers compensation insurers offering high deductible policies, one thing was clear to regulators. These insurers were exposed to solvency risk that was not captured in the financial statement disclosures under statutory accounting principles.

What Is a High Deductible Policy and Why Do They Keep Regulators Up at Night?

There is no universal dollar threshold for high deductibles. Some insurers consider $100,000 a high deductible, while others set the bar at $1,000,000. Regardless, for these policies, the insurer pays the full claim amount and the policyholder reimburses the insurer for the deductible. If the policyholder does not reimburse the insurer, the insurer may get relief from collateral received from or pledged by that policyholder (e.g., letter of credit, funds held). However, managing collateral needs is no simple task, particularly in the workers compensation industry. The following examples demonstrate why.

- An insurer sells a workers compensation policy with a $500,000 per claim deductible on January 1, 2017, to an employer who reports 500 employees under the policy. The insurer obtains a letter of credit from the policyholder estimated to cover the exposure under the deductible. However, the number of employees under the policy increases significantly during the policy period. By the time the insurer performs a policy audit and discovers the growth, it is evident there are collections issues with the policyholder and the letter of credit is insufficient to cover the deductible for anticipated claims based on the increase in the number of employees covered.

- Expanding on the previous example, let us assume the insurer has several high deductible policyholders with no initial collections issues. The policies are renewed annually for 10 years, and the insurer obtains letters of credit to satisfy estimated collateral needs for each policy year. The insurer's internal actuary reviews high deductible policies in the aggregate, but no analysis is performed to separately estimate the exposure for individual policyholders whose business is significant to the insurer. The insurer has a concentration of risk with its largest high deductible policyholders. A separate analysis would have shown that one policyholder has had increasing claims frequency over the past 5 years. However, decreases in frequency of claims among the other high deductible policyholders offset that trend, causing the actuary's analysis to overlook the trend. The policyholder with the increasing claims frequency suddenly stops reimbursing the insurer and, shortly thereafter, files for bankruptcy. When the actuary projects the estimated exposure under the deductible that they cannot expect to recover (amounts in excess of the letters of credit), he or she identifies the increasing frequency trend. The actuary applies the trend to the loss and loss adjustment expense projections over a 20-year estimated tail length, finding the exposure to be significantly more than the available collateral.

Recent workers compensation insurance insolvencies related to high deductible policies have made headlines and have left regulators wondering how they did not see this coming.

Why the Focus on PEOs?

No discussion on this topic is complete without referencing professional employee organizations (PEOs), which have been behind most of the recent insurance company insolvencies stemming from high deductible issues. These organizations enter into co-employment contracts with their clients, meaning the PEO and client share in the responsibility of employment and control over the employees. In these scenarios, special endorsements must be made to workers compensation policies to specify whether the PEO or its client is responsible for workers compensation benefits for the employee. While the parties can negotiate who is responsible, both parties must hold a policy with an endorsement either extending or excluding benefits to shared employees. Even if the PEO is responsible for providing workers compensation benefits to shared employees, it is important for the client to have a policy in place to protect itself legally (e.g., the PEO suddenly goes out of business), and vice versa. These PEO relationships present more risk to workers compensation insurers because of the following.

- They provide staffing for multiple clients in a variety of industries, and head counts can swing dramatically during the policy period. Those swings may increase the insurance company's exposure to credit risk without the insurance company being aware.

- Since PEOs pose additional concentration risks, insurers need to evaluate their risk exposure at the aggregated PEO group level as well as the aggregated client level, regardless of which party is contractually responsible for providing the workers compensation benefits. Additionally, insurers must understand the exposure it has if the PEO or the client declares bankruptcy and the deductible amounts are no longer collectible.

High Deductible Financial Reporting—Before

Prior to these insolvencies, financial statements did not quantify the volume of credit risk related to these policies. The balance sheet presents reserves net of deductibles, which assumes all high deductibles on incurred but not reported (IBNR) and case reserves are collectible. Even the gross loss data in Schedule P is net of high deductibles. The only scenario under which an insurer is expected to increase reserves and recognize collectibility risk on the deductibles built into gross reserves is when currently billed and recoverable amounts for the same policyholder are determined to be uncollectible. Only then would an insurer disclose information related to its high deductible exposure.

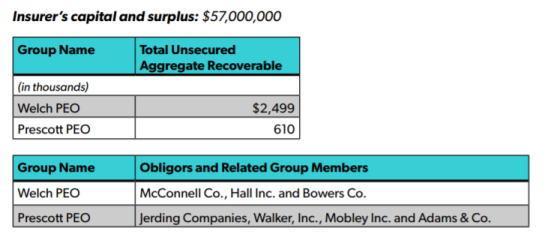

For 2016 reporting, the regulators added a "Band-Aid" disclosure requirement targeted at PEOs (or other similar entity structures where the individual obligor is part of a group under common management or control) to list the individual obligors, each of their related group members, and the total unsecured aggregate recoverables on high deductible policies for the entire group.

High Deductible Financial Reporting—Beginning for Years Ended December 31, 2017

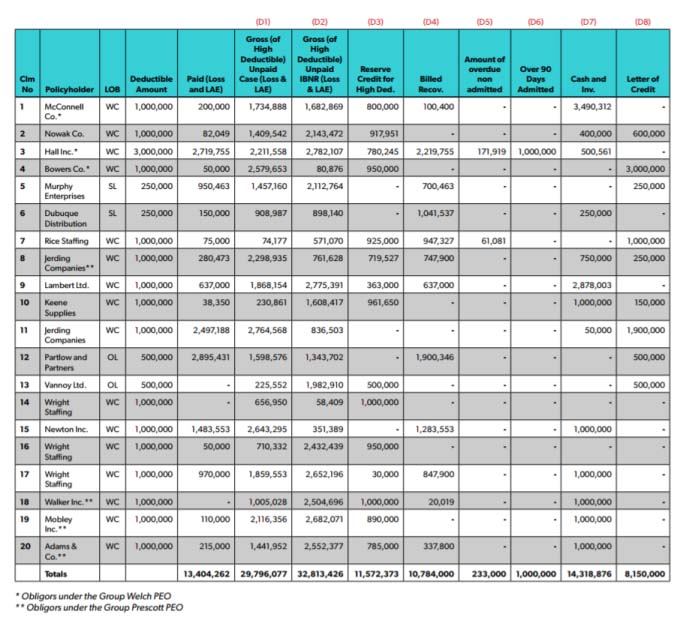

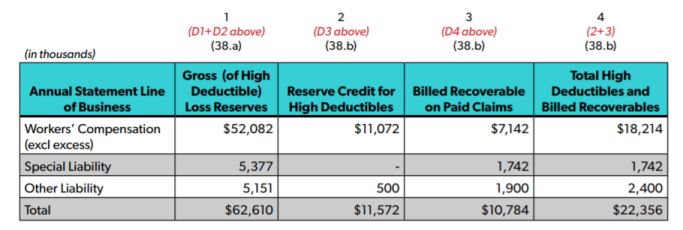

The revisions adopted in June 2017 to SSAP No. 65, Property and Casualty Contracts, are intended to be a more comprehensive solution to add disclosures addressing solvency concerns. The following simplified data set is presented to demonstrate the data needed to complete the new disclosure requirements effective for 2017 year-ends.

Disclosure requirements under SSAP No. 65, paragraph 38, for all high deductible policies are as follows.

38 a. Gross (of high deductible) amount of loss reserves, unpaid by line of business

38 b. The amount of reserve credit that has been recorded for high deductibles on unpaid claims and the amounts that have been billed and are recoverable on paid claims, by line of business and the total of these two numbers

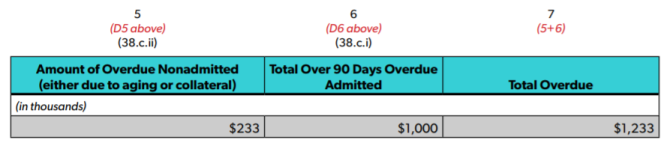

38 c. Related to the amounts that have been billed and are recoverable on paid claims:

i. paid recoverable amounts that are over 90 days overdue and

ii. the amounts nonadmitted (per paragraph 37).

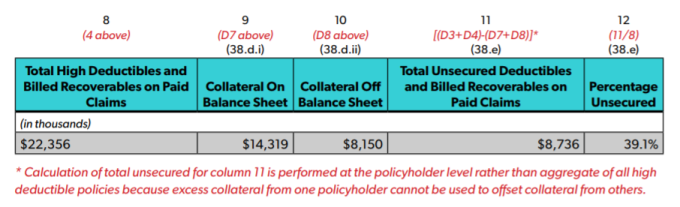

38 d. Total collateral pledged to the reporting entity related to deductible and paid recoverables:

i. the amount of collateral on balance sheet and

ii. the amount of collateral off balance sheet.

38 e. The total amount of unsecured high deductible amounts related to unpaid claims and for paid recoverables and the total percentage that is unsecured

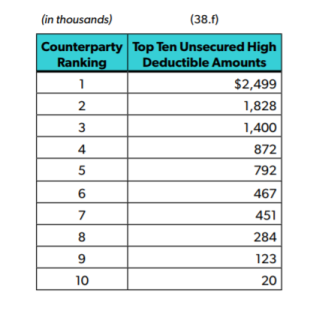

38 f. Highest 10 unsecured high deductible amounts by counterparty ranking. Note that the counterparty does not have to be named, just amount by counterparty 1, counterparty 2, etc. For this purpose, a group of entities under common control shall be regarded as a single customer.

Additional disclosures under SSAP No. 65, paragraph 39, for unsecured high deductible recoverables are also required provided the individual obligor is part of a group under the same management or control, such as a PEO. These disclosures include listing the individual obligors, each of its related group members, and the total unsecured aggregate recoverables on high deductible policies for the entire group that are greater than 1 percent of capital and surplus. For this purpose, a group of entities under common control shall be regarded as a single customer.

Property and casualty insurers with high deductible policies can expect to see tables similar to these examples in the 2017 Annual Statement Blanks. Insurers who do not already analyze unpaid loss and loss adjustment expense data relative to collateral in sufficient detail to prepare these disclosures and provide support for them to their auditors should prepare to do so for the 2017 year-end.

Kia Bickel | September 20, 2017