Global Economic Losses $36 Billion So Far in 2018, over Half Insured

August 17, 2018

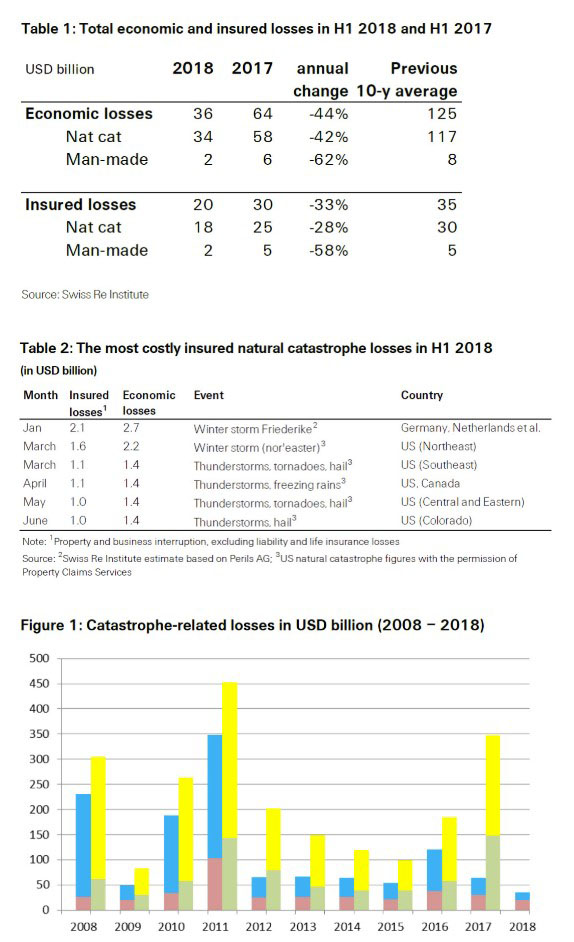

Swiss Re said its preliminary sigma estimates surrounding global economic losses from natural catastrophes and man-made disasters in the first half of 2018 were $36 billion. According to Swiss Re, this figure is well below the 10-year average of $125 billion in economic losses and significantly lower than the losses reported for the same period a year earlier. The findings showed that of the total global economic losses in the first half of 2018, $20 billion were covered by insurance.

In the first half of 2018, a series of winter storms in Europe and in the United States caused the largest losses. Of the $36 billion in total global economic losses, natural catastrophes accounted for the majority, or $34 billion in the first half of 2018, compared to $58 billion in the first half of 2017. The remaining $2 billion of losses were caused by man-made disasters. Global insured losses from natural catastrophes fell to $18 billion from $25 billion the year before, while insured losses from man-made disasters decreased to $2 billion from $5 billion in the first half of 2017. Nearly 56 percent of all global economic losses were insured, as most disastrous events occurred in areas with high insurance penetration.

Harsh Winter Weather in Europe and the United States

From a loss perspective, Cyclone Friederike in Europe was the costliest event in the first half of 2018. The storm caused significant losses in Germany and the Netherlands, although France, Belgium, and the United Kingdom were also impacted. Swiss Re estimates the total economic losses at $2.7 billion. Approximately $2.1 billion of these losses were insured.

A series of winter storms in the United States, including the "Nor'easter" storm in March, brought heavy snow, ice, freezing rains, and flooding from snowmelt and coastal flooding to large parts of the United States, causing total economic losses of $4 billion, including $2.9 billion in insured losses. The March Nor'easter storm was the largest loss for the insurance industry in the United States during the first 6 months of 2018, with claims of $1.6 billion.

Other Events during the First Half of 2018

A series of convective storms, including thunderstorms, tornadoes, and hailstorms, hit the United States, Europe, and other parts of the world. The costliest event for the insurance industry was a 4-day spring storm that affected the Southeastern states of the United States with tornadoes and large hail, resulting in combined insured losses of over $1.1 billion.

In addition, major volcanic eruptions in Hawaii and Guatemala and earthquakes in Japan, Taiwan, and Papua New Guinea have caused damages, which have not yet fully determined insured losses.

Higher Losses May Still Lie Ahead for 2018

Already in the first half of 2018, several parts of the world have been in the grip of heatwaves and severe dry weather conditions, triggering major wildfire outbreaks in California and Greece and causing widespread drought across Europe and southern Australia. Numerous regions are exposed to above-average temperatures and drier weather conditions. Southern Australia, for example, is experiencing its second-driest autumn on record according to the Australian Bureau of Meteorology. Losses from droughts in the agriculture sector and from wildfires are yet to be determined.

Martin Bertogg, head of catastrophe perils at Swiss Re, said, "We expect to see more extreme weather conditions such as intense heatwaves and dry spells of the like we've seen over the last few weeks. This may well become the new normal. According to scientific climate models, temperature, and atmospheric humidity will increase in many parts of the world, and at the same time also become more volatile." Mr. Bertogg adds, "We will experience more variable rain patterns and severe droughts and in consequence raging wildfires. Accelerating urbanisation and the ongoing expansion of dwellings in natural forest areas will considerably exacerbate this loss potential. Society will need to adapt and prepare for these increasing occurrences."

August 17, 2018