US/China Trade Conflict Poses the Top Risk to Global Growth

November 14, 2019

Insurance markets continue to support resilience, with global premiums forecast to increase by 3 percent annually in real terms in 2020 and 2021, despite a slowing world economy according to the latest Swiss Re sigma, "Sustaining resilience amid slowing growth: global economic and insurance market outlook 2020/21."

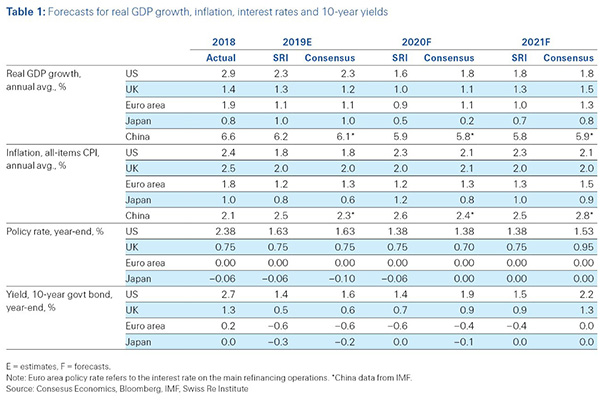

Swiss Re forecasted US and Euro area growth next year of 1.6 percent and 0.9 percent, respectively, both below consensus. The main engine of the global economy will be emerging Asia, with near 6 percent growth in both India and China. The contribution of insurance to resilience will be greatest in this region as well. In China, nonlife premiums are forecast to grow by 9 percent in 2020, and life premiums by 11 percent.

"Our outlook on global growth has deteriorated from a year ago," Jerome Jean Haegeli, group chief economist at Swiss Re, said. "The US/China trade conflict has been more far-reaching than anticipated. In a broader sense, geopolitical developments have not improved. Rather, we have seen more polarization across the world, all of which has added to the environment of uncertainty, including for business. Going forward, the US/China trade conflict poses the top risk to global growth."

Japanification: Coming to You?

Due to the environment of worsening trade and geopolitical developments over the last year, Swiss Re lowered its growth forecasts for advanced markets and forecasts that gross domestic product (GDP) growth in the United States will slow to 1.6 percent in 2020 from 2.3 percent this year as the effects of fiscal stimulus fade and trade tensions with China continue. This is below the consensus forecast for 2020 of 1.8 percent. The risk of recession in the United States remains elevated at 35 percent, but this is not Swiss Re's base-case scenario. According to sigma analysis, the US economy is the most resilient compared to the other G4 nations, and growth there is expected to strengthen slightly to 1.8 percent in 2021. 1

On aggregate, emerging market growth should improve modestly over the next 2 years, Swiss Re said. While Asia will remain the motor of global growth, particularly emerging Asia, there is positive momentum in other regions as well. The outlook for some large Latin American countries, notably Brazil, has improved compared to last year, and growth in Africa is also strengthening moderately. The ongoing trade dispute with the US will weigh on growth in China, but with ramped up fiscal and monetary easing, Swiss Re forecasts a 6.1 percent gain in GDP there next year.

Low and Negative Interest rates Are Here To Stay

Decisive monetary policy action was crucial, needed, and successful in response to the global financial crisis. However, "in the long term, negative interest rates are negative, leading to higher household savings, misallocation of capital, higher debt levels, and leverage and lower bank and also insurer profitability," Mr. Haegeli said.

He continued, "In the short-term, the low growth environment does not necessarily mean financial markets will perform badly, not while central banks remain in accommodative mode. Long-term loose monetary policy, however, raises the specter of financial instability."

With monetary policy options largely exhausted, new growth recipes are needed to offset increasing headwinds from demographics, protectionism, and political uncertainty. To improve productivity, supply-side reform efforts need to be stepped up and public investment increased. Fiscal stimulus will likely pick up the baton in the coming years. Fiscal stimulus can increase the productive capacity of an economy, for example, through spending on infrastructure projects and in sustainable investments.

Insurance Supports Resilience

Insurance is a key contributor to economic resilience, more so when growth slows: when households and businesses have access to financial compensation for loss events, the underlying capacity of an economy to absorb shocks is enhanced. Encouragingly, the global insurance sector continues to grow at trend. Nonlife and life premiums are forecast to increase by around 3 percent in both 2020 and 2021. By closing existing protection gaps, the insurance industry can further support macroeconomic resilience.

Emerging Asia is seen as the main driver of industry growth led by China, where nonlife premiums are forecast to grow by 9 percent in 2020 and life premiums by 11 percent. Further out, Swiss Re forecasts that China will account for 60 percent of all insurance premiums in Asia over the next 10 years. Expanding risk pools will include non-motor personal and medical and health covers.

"The exponential growth of midmarket private medical in China, with premiums up 1500 percent over the last 2 years, offers an indication of the size of potential," Mr. Haegeli said. "Resilience levels in other emerging markets could be strengthened significantly by taking learnings from the China experience."

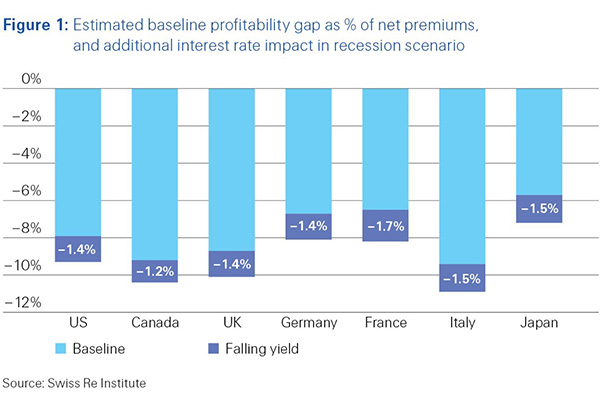

Pricing in nonlife insurance has strengthened, driven by rising loss costs in property catastrophe and US casualty, and Swiss Re expects this to continue. Profitability has been trending up in both nonlife and life insurance, although this is partly due to realized gains from the investment portfolio. However, in the case of a recession, demand for insurance typically falls with economic slowdown, and profitability would also be impacted. For example, for the nonlife sector overall, the analysis shows that a 50 basis-point drop in the yield curve, a plausible scenario in current low market yield levels, would widen the estimated existing sector margin gap of 6–9 percent of premiums by 1.2–1.5 percent.

A claims disinflation effect could, in part, offset the interest rate impact. Certain lines of business, like casualty, tend to benefit from reduced claims severity via economic drivers (e.g, wage inflation and medical expenses). On the other hand, social inflation, the impact of changes in the tort system through which most liability claims are settled, is putting upward pressure on loss costs. This is becoming an especially prevalent theme in US liability insurance. Further, the low-interest-rate environment means that investment returns remain weak, which will continue to undermine profitability, particularly for life insurers.

The experience of insurers in Japan in 3 decades of low growth and low interest rates offers pointers for peers in other regions facing a similar scenario of economic inertia. In search of yield, Japan's insurers have invested much more of their assets abroad. Nonlife insurers have also turned more aggressive in their investment strategy by significantly reducing cash and reserves and increasing their exposure to equities. On the life side, insurers have also changed their product mix to write more higher-margin health products and less interest-rate sensitive savings products.

- See sigma 5/2019: "Indexing resilience – a primer for insurance markets and economies," Swiss Re Institute

November 14, 2019