Insurers Seek Out Differentiating Capabilities with Advanced Analytics

August 22, 2019

Technology advances in the form of advanced analytics are enabling property and casualty (P&C) insurers to unlock new frontiers in risk assessment and mitigation, according to Swiss Re's latest sigma report, titled "Advanced analytics: unlocking new frontiers in P&C insurance."

The report found that past successes focused on improving expense ratios have catalyzed new investment with pilots by insurers showing meaningful improvement in loss ratios, as insurers gain better visibility into underlying loss drivers.

Swiss Re said that while true potential will only be realized through coordinated efforts between developers and users, expectation of success in all projects could limit adoption and constrain the circle of trial and improvement.

"Most insurers aim for a success rate of one-third in operationalizing pilots. Too high a success rate may mean that the use cases are not challenging enough," said Daniel Knüsli, Swiss Re's head P&C analytics, P&C solutions.

Exploring the Opportunities for Advanced Analytics

Advanced analytics will undoubtedly make an impact along the insurance value chain. Challenges to success remain in the form of legacy systems, traditional mind-sets, and scarce talent at the intersection of data science, risk knowledge, and technology. Despite this, the Swiss Re Institute expects spending on data and analytics to rise within static information technology budgets as more insurers complete core systems updates over the coming years and seek out differentiating capabilities.

Swiss Re believes that advanced analytics should be considered from the perspective of business capabilities rather than technologies. Business capabilities include the following.

- How to enable growth by using analytics to achieve an in-depth understanding of new market opportunities and new risk pools

- How to better comprehend and influence customers

- How to gain insights on risk accumulation and portfolio steering through linking existing portfolios with orthogonal external data sets

- How to improve efficiency by automating manual and repetitive tasks that take up valuable time for underwriters and claims managers

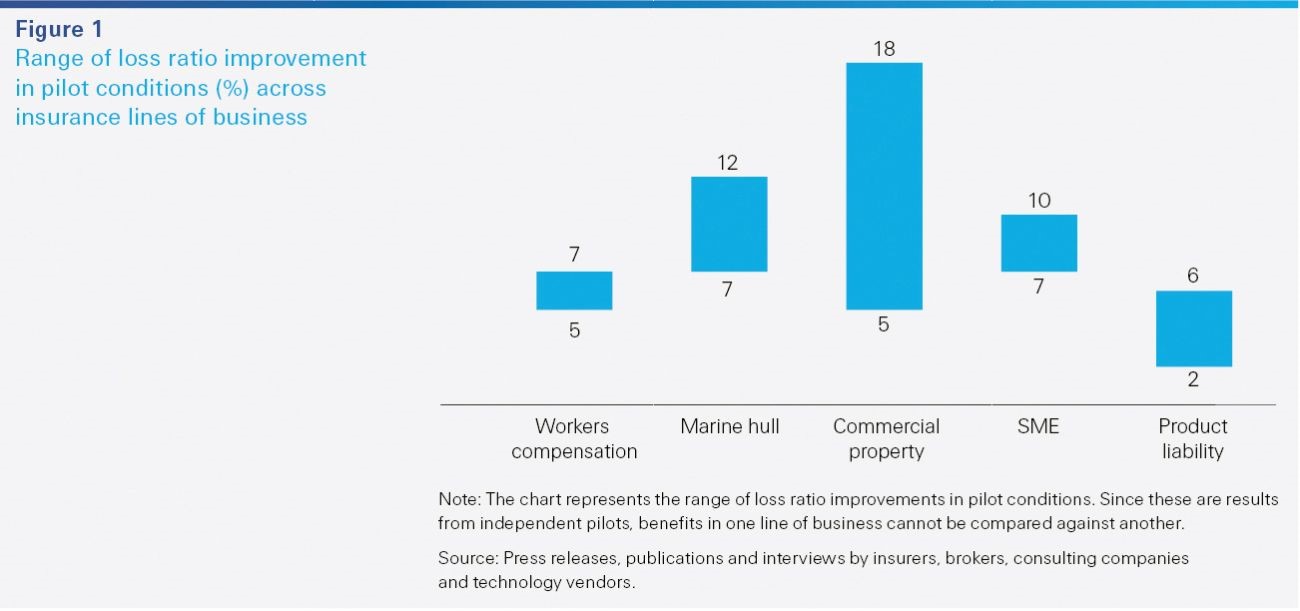

Swiss Re found that advanced analytics pilots across several lines of business indicate healthy loss ratio improvements (see Figure 1). All told, most insurers seem to be targeting around 2–5 percent improvement in loss ratios.

A Holistic View of Advanced Analytics Activities Across P&C

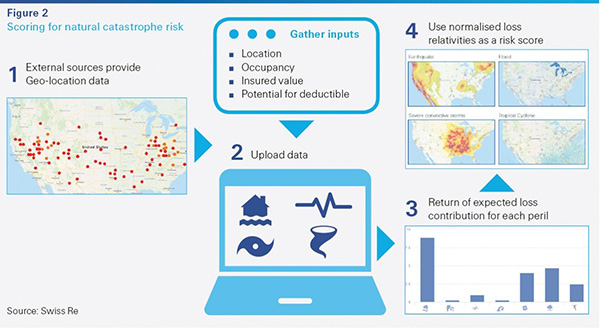

In commercial property, insurers are using data to autofill underwriting criteria for new business and renewals and moving towards virtual inspection platforms. Data about location and occupancy can be modeled to produce risk scores that enable underwriters to base risk selection and price on market-wide experience (see Figure 2).

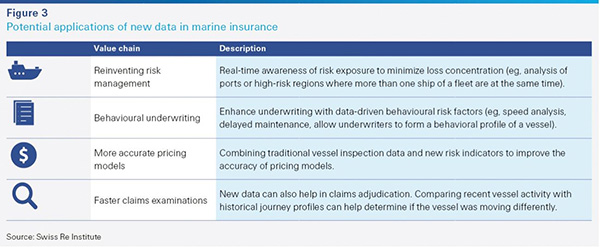

In marine, insurers can now use detailed behavioral and situational data on over 100,000 vessels to identify risky behavior and monitor risk concentration, opening the path toward "pushing" the insured to improved preventative measures (see Figure 3).

Making the Case for Investment in Advanced Analytics

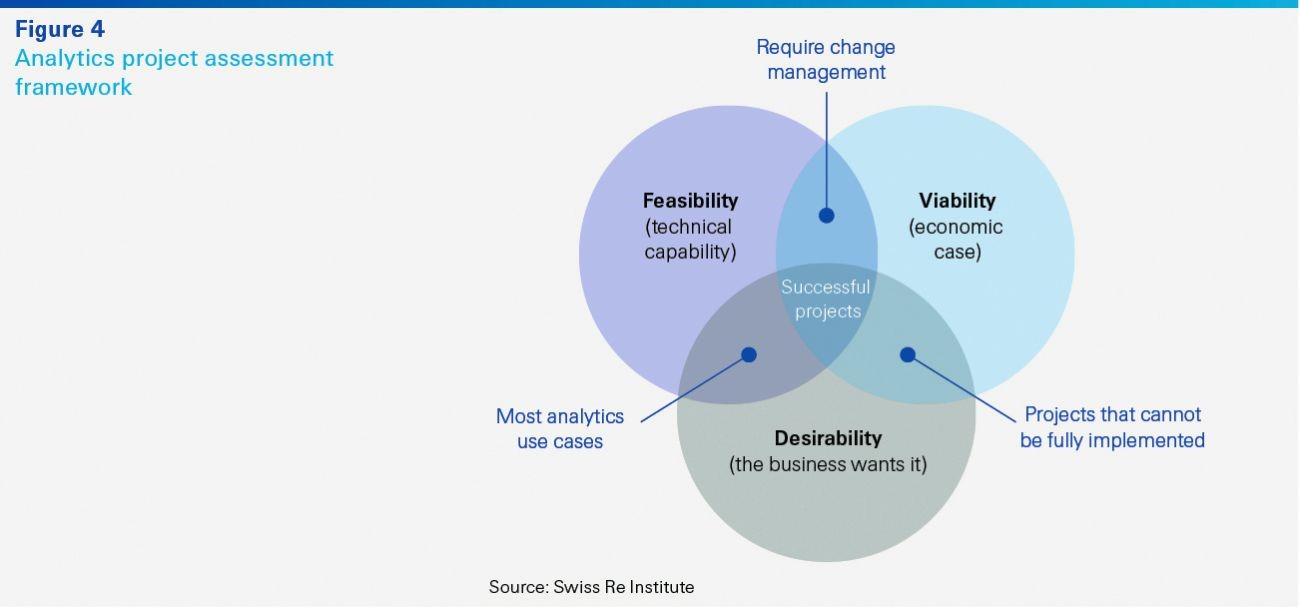

Successful implementations of analytics projects start with insurers asking the right questions on value propositions and data sources—e.g., how to identify areas where analytics generate tangible value, how to build a holistic data strategy, and what are the success criteria (e.g., return on investment and time horizon)? One useful framework to determine the value of projects is to evaluate them across desirability, feasibility, and viability (see Figure 4). Insurers should focus initially on areas where there is high potential on all three fronts.

August 22, 2019